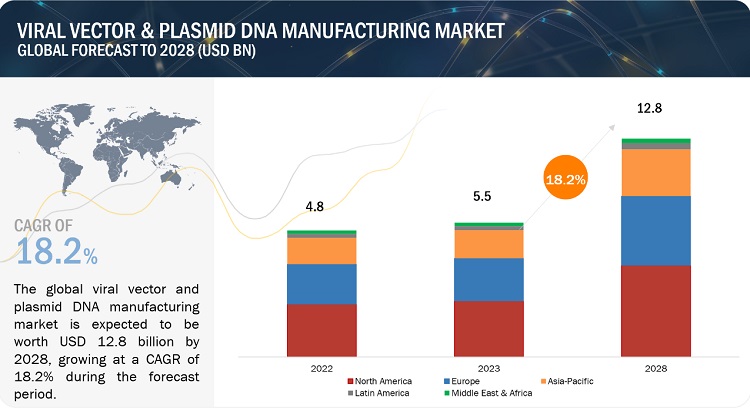

Viral Vector Manufacturing Market in terms of revenue was estimated to be worth $5.5 billion in 2023 and is poised to reach $12.8 billion by 2028, growing at a CAGR of 18.2% from 2023 to 2028 according to a new report by MarketsandMarkets™. The growth of this market is driven by rising prevalence of target diseases and disorders, the availability of funding for gene therapy development, effectiveness of viral vectors in gene therapy delivery, and ongoing research into viral vector-based gene and cell therapies, leading to expanded applications and adoption of viral vector and plasmid DNA manufacturing technologies.

Download an Illustrative overview:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=89341986

Browse in-depth TOC on "Viral Vector Manufacturing Market"

363 - Tables

50 - Figures

332 – Pages

The Plasmid DNA segment accounted for the largest share, by type in the viral vector & plasmid DNA manufacturing industry in 2022.

By type, the viral vector & plasmid DNA manufacturing market has been further categorized as viral vector and plasmid DNA. The plasmid DNA segment held the largest share of the global viral vector and plasmid DNA manufacturing market in 2022. This can be attributed to Increasing R&D and the growing launches of plasmid DNA production platforms. Plasmid DNA plays a crucial role in this research and developments. Plasmids are often used in genetic engineering and biotechnology for various purposes, including gene cloning, gene expression, and recombinant protein production.

The downstream manufacturing segment accounted for the largest share of the workflow segment in the viral vector and plasmid DNA manufacturing market in 2022.

Based on workflow, the global viral vector and plasmid DNA manufacturing market has been segmented into upstream manufacturing and downstream manufacturing. The downstream manufacturing segment held the largest market share in 2022. The large share of this segment can be attributed to development of efficient purification techniques and processes that result in high yields of purified products.

The North America region catered the largest share of the viral vector and plasmid DNA manufacturing industry in 2022.

The viral vector and plasmid DNA manufacturing market in North America has experienced significant growth in recent years, showcasing a robust expansion trajectory, owing to the well-established research infrastructure, strong pharmaceutical and biotech industry, increasing government support for life science research, technological advancements in viral vector and plasmid DNA manufacturing technologies, and collaborative initiatives contribute to the growth of the viral vector and plasmid DNA manufacturing market in the North America region. Additionally, North America faces a significant burden of chronic diseases, including cancer, cardiovascular diseases, and neurological disorders. The increasing prevalence of chronic diseases in the region drives the demand for viral vector and plasmid DNA manufacturing for both research and clinical applications.

Request Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=89341986

Viral Vector Manufacturing Market Dynamics:

Drivers:

· Rising prevalence of genetic disorders, cancer, and infectious diseases

· Availability of funding for development of gene therapy

· Effectiveness of viral vectors

· Ongoing research on viral vector-based gene and cell therapies

Restraints:

· High operational costs associated with cell and gene therapy manufacturing

· Short shelf life of viral vectors

Opportunities:

· Smart capital deployment and planning for scalability

· Leveraging digital tools to facilitate operational excellence

Challenges:

· Risk of mutagenesis and other unwanted outcomes

· Individual optimization and low yield

Key Market Players:

Key players in the viral vector and plasmid DNA manufacturing market include Lonza Group AG (Switzerland), Merck KGaA (Germany), Thermo Fisher Scientific Inc. (US), Charles River Laboratories International, Inc. (US), Catalent Inc. (US), WuXi AppTec (China), FUJIFILM Corporation (Japan), GenScript Biotech Corporation (US), Takara Bio Inc. (Japan), Oxford Biomedica (UK), Novartis AG (Switzerland), Precision Biosciences (US), Bluebird Bio, Inc. (US), Sartorius AG (Germany), Danaher Corporation (US), SIRON Biotech (Germany), VGXI, Inc. (US), Waisman Biomanufacturing (US), Kaneka Eurogentec S.A. (Belgium), PlasmidFactory GmbH (Germany), ATUM (US), Addgene (US), Cell and Gene Therapy Catapult (UK), Batavia biosciences (Netherlands), and Altogen Biosystems (US).

Recent Developments:

· In August 2022, MERCK KGaA the VirusExpress 293 Adeno-Associated Virus (AAV) Production Platform, which offers a full viral vector manufacturing offering including AAV, Lentiviral vectors.

· In May 2022, Catalent Inc., launched UpTempo Virtuoso platform process for the development and manufacturing of adeno-associated viral (AAV) vectors.

Get 10% Free Customization on this Report:

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=89341986