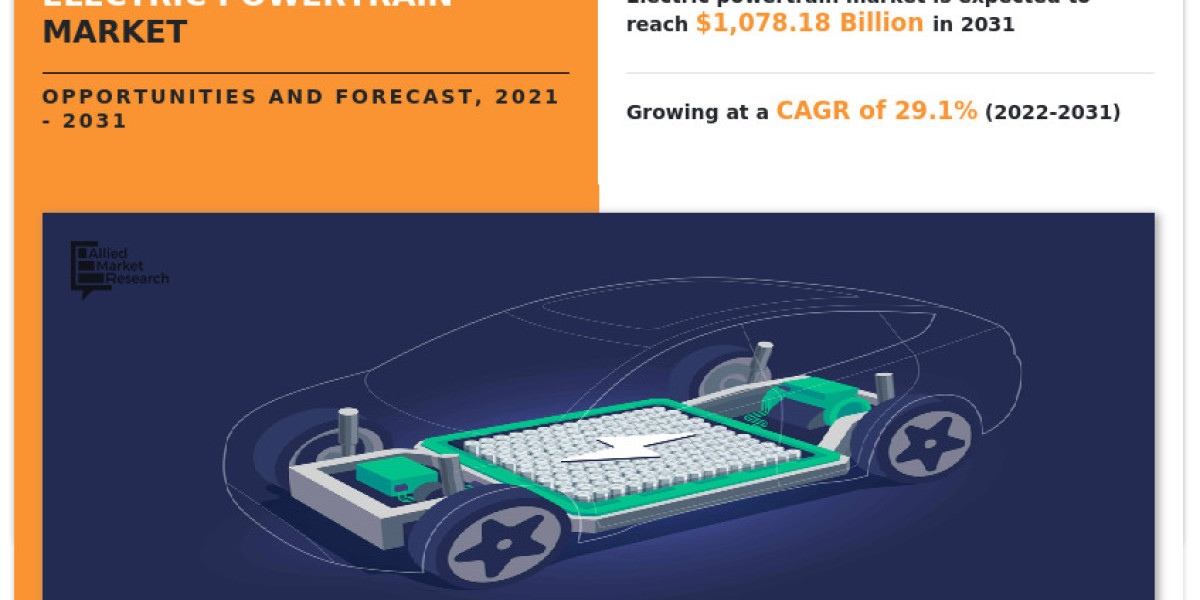

According to a new report published by Allied Market Research, titled, “Electric Powertrain Market," The electric powertrain market was valued at $83.66 billion in 2021, and is estimated to reach $1,078.18 billion by 2031, growing at a CAGR of 29.1% from 2022 to 2031.

An electric powertrain is the group of components in an electric vehicle that transfers power from the battery to the surface where the vehicle runs. The component in an electric powertrain includes inverter, which converts the battery DC power to AC and drives the induction motor in vehicle for propulsion. Moreover, electric motor is an important part of electric powertrain development as it converts electricity to torque to move the vehicle. The electric powertrain of a vehicle is defined by its performance, comfort, and safety. The automotive powertrain portfolio is diversified and includes many pure electric and hybrid powertrains. In addition, the overall powertrain landscape has become more dynamic and complex with the emergence of technology such as innovation in battery technologies and supportive government policies. For instance, in January 2022, Magna International Inc. unveiled the EtelligentForce, a battery electric 4WD powertrain system for pickup trucks and light commercial vehicles. The system had fewer moving parts than a traditional ICE powertrain, thereby requiring less maintenance.

??????? ?????? ?????- https://www.alliedmarketresearch.com/request-sample/10456

In addition, the electric powertrain market has witnessed significant growth in recent years, owing to increased demand for improved vehicle performance and the inclination of consumers toward environment-friendly vehicles. For instance, in April 2022, Magna International Inc. announced the opening of a new manufacturing plant in Ramos Arizpe, Mexico. The 260,000 square foot facility produced inverters, motors, and on-board chargers for use in General Motors’ series of electric vehicles (EVs). Furthermore, the companies operating in the electric powertrain market have adopted partnerships, investments, and product developments to increase their market share and expand their geographical presence. Moreover, major automotive component manufacturers have been investing in electric axle drives to capitalize on the increasing sales of electric and hybrid vehicles to increase their market share. For instance, in August 2021, Schaeffler AG brought in further development in its electric axle by introducing the 800-volt power electronics and thermal management system. These improvements increased the efficiency of the electric drive, which further increased the effective range of electric vehicles.

The factors such as growth in trend of downsized engines, increase in sales of electric vehicles, and stringent vehicular emission norms & regulations propel the demand for electric powertrain market. However, high manufacturing costs and range anxiety & serviceability are the factors expected to hamper the market growth. In addition, rocketing infrastructural developments of EV infrastructure and advancement in technology are some of the factors that create lucrative opportunities for the electric powertrain market during the forecast period.

??????? ???????? ???????? ??????- https://www.alliedmarketresearch.com/electric-powertrain-market/purchase-options

COVID-19 Impact Analysis:

The electric powertrain market could not escape from the demand & supply chain disruption and remains susceptible, owing to its dependence on the global supply chains for its core technology services. Various companies operating in the automotive industry are stepping up by reconfiguring their supply chain, production, and services for delivery of critical medical supplies. For instance, India’s largest automaker, Maruti Suzuki collaborated with Nigen Equipment Pvt Ltd and SAM Gas Projects Pvt Ltd to produce more oxygen to meet the demand. Bajaj Auto, market leader in the three-wheeler market came out to assist its employees who lost their battle in COVID-19 by paying them two year’s salary. However, in the second half of 2020, when lockdowns were lifted or relaxed for some time, there was high growth in EV sales during the pandemic, as governments worldwide progressively encouraged people to switch to low-emission fuel vehicles. This led to growth in demand for electric powertrain system around the world. According to International Energy Agency (IEA), both in Europe & China, electric car sales reached about 1.3 million in 2020, of which 10% is of Europe & 5% is of China. In addition, in the U.S., despite a lack of EV stimulus measures at a federal level, the EV sales were 4% higher than in 2019, which further shows both consumer demand on one hand and R&D and scale-up efforts from the EV industry on the other hand.

FREE Consultation Call with Our Analysts to Find Solutions for Your Business – https://www.alliedmarketresearch.com/connect-to-analyst/10456

KEY FINDINGS OF THE STUDY

- By component, on-board charger segment is anticipated to exhibit a remarkable growth during the forecast period.

- On the basis of vehicle type, the commercial vehicle segment is anticipated to exhibit a remarkable growth during the forecast period.

- On the basis of vehicle class, the luxury segment is the highest contributor to the electric powertrain market in terms of growth rate.

- By vehicle drive type, the rear wheel drive segment is anticipated to exhibit a remarkable growth during the forecast period.

- On the basis of application, the battery electric vehicle (BEV) segment is expected to exhibit a remarkable growth during the forecast period.

- By region, LAMEA would exhibit higher growth rate as compared to other regions.

Request for Customization – https://www.alliedmarketresearch.com/request-for-customization/10456

The key players operating in the electric powertrain market are BorgWarner, Robert Bosch GmbH, Continental AG, Dana Incorporated, Denso, Hitachi, Magna International Inc., Magneti Marelli Ck Holdings, Mitsubishi Electric Corp., Nidec Corporation, Panasonic, Schaeffler AG, Toyota Industries Corporation, Valeo, ZF Friedrichshafen AG, Brusa Electronik (Key Innovator) and Kelly Controls, Inc. (Key Innovators).