The Global report "Cell Culture Market gauged by its revenue, was valued at approximately $27.9 billion in the year 2023. Anticipated with great promise, this market is projected to ascend to a substantial worth of $51.3 billion by the year 2028, demonstrating an impressive Compound Annual Growth Rate (CAGR) of 12.9% during the span from 2023 to 2028. This dynamic growth trajectory underscores a captivating narrative in the realm of cellular research and innovation.

Within the ambit of this newly conducted research endeavor, a comprehensive analysis of prevailing industry trends has been meticulously crafted. This exploration delves into multifaceted dimensions, encompassing nuanced pricing dynamics, insightful patent analyses, the rich tapestry of conferences and webinars, the mosaic of key stakeholders, and an intricate dissection of market-oriented buying behaviors. This study radiates as a beacon of knowledge, providing a panoramic vista into the evolving landscape of cell culture.

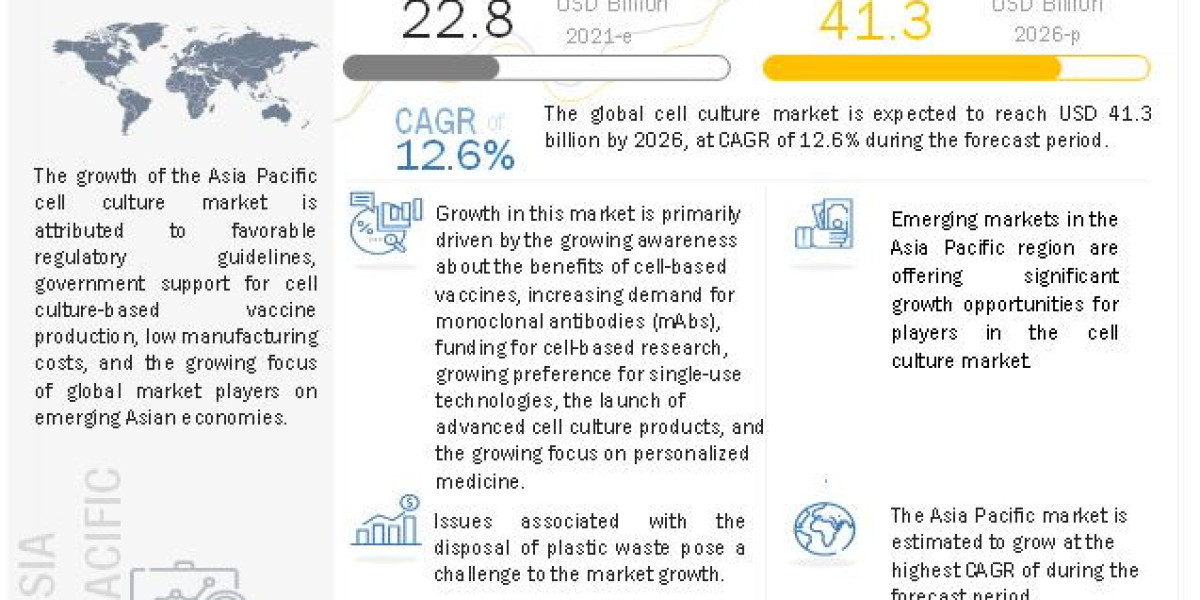

The impetus behind the resounding expansion of this market emanates from a confluence of factors, most notably the robust support and funding extended by governmental bodies towards pioneering cell-based research. In tandem with this, the stage is set for an entrancing crescendo facilitated by the emergence of cutting-edge cell culture technologies, particularly those that underpin the development of cell-based vaccines. Moreover, the market's horizons are further broadened by the palpable surge in demand for three-dimensional (3D) cell cultures, supplanting the conventional two-dimensional (2D) counterparts. This paradigm shift signifies an avenue of opportunity that augments the market's upward trajectory, fostering an ecosystem of innovation and transformative growth.

Download PDF Brochure@ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=559

Browse in-depth TOC on "Cell Culture Market"

692 - Tables

42 - Figures

556 - Pages

Key Market Players:

The global cell culture market is a consolidated market, with Thermo Fisher Scientific (US), Danaher Corporation (US), Merck KGaA (Germany), Sartorius AG (Germany), Corning Incorporated (US) together accounting for ~70–75% of the global market.

Cell Culture Market Dynamics:

Drivers:

- Government support and funding for cell-based research

- Emerging cell culture technologies for cell-based vaccines

- Growing popularity of monoclonal antibodies

- Adoption of single-use technologies

- Growing focus on product development

- Growth in cell and gene therapies and stem cell research

- Incidence of infectious diseases

Restraints:

- High cost of cell biology research

- Limitations in producing high-density cell cultures

Opportunities:

- Demand for 3D over 2D cell cultures

- Growth hotspots in emerging economies

Challenges:

- Disposal of plastic consumables

The equipment segment accounted for the second largest share, by product in the the cell culture market in 2022.

Based on equipment, the cell culture market is segmented into supporting equipment, bioreactors, and storage equipment. Cell culture involves the extensive use of laboratory equipment such as bioreactors, storage equipment, and cell culture-supporting equipment. The growing awareness about the benefits of cell culture-based vaccines (coupled with the growing regulatory approval for these products), increasing production of mAbs, and the introduction of technologically advanced products for high-demand applications (such as cell & gene therapy and regenerative medicine) are the key factors driving the growth of the cell culture equipment market.

The monoclonal antibody production segment accounted for the largest share of the biopharmaceutical production segment in the cell culture market in 2022.

Based on biopharmaceutical production, the cell culture market is categorized into monoclonal antibody production, vaccine production, and other therapeutic protein production. Monoclonal antibodies are multifunctional components of the immune system that fight infections. Most antibodies generated as a natural response are polyclonal, which means they are produced by several B lymphocytes. Monoclonal antibodies, on the contrary, are produced in laboratories and can bind to single specific targets in the body, such as antigens on the surface of certain cancer cells.

The North America region catered the largest share of the cell culture market in 2022.

The growing regulatory approvals for and awareness of cell culture-based vaccines, rising investments in biopharmaceutical R&D coupled with various initiatives from the leading companies, and conferences and symposia that create awareness of the latest cell culture trends are the key factors driving the growth of the cell culture market in North America. Biopharmaceutical companies in North America focus on R&D activities to develop and commercialize novel drugs and therapies. Additionally, various initiatives from leading companies have accelerated growth in North America.

Recent Developments

- In February 2022, Thermo Fisher Scientific announced a 15-year strategic collaboration agreement to enable dedicated large-scale manufacturing in the US.

- In October 2022, Cytiva acquired Cevec Pharmaceuticals GmbH, which is expected to strengthen Cytiva's leading position in biomanufacturing solutions.

Request 10% Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=559