The B2B Payments Transaction Market involves payment solutions and electronic payment systems that connect businesses and facilitate transactions between business entities. B2B payments enable direct deposit, electronic invoices, expense reimbursements and vendor payments in real-time. High transaction volume in B2C e-commerce has boosted adoption of digital payments among B2B merchants as well.

The Global B2B Payments Transaction Market is estimated to be valued at US$ 3,021.25 Bn in 2024 and is expected to exhibit a CAGR of 6.8% over the forecast period 2024 to 2031.

Key Takeaways

Key players operating in the B2B Payments Transaction market includes Mastercard Inc., FIS , Stripe, Inc. , Paystand, Inc., Flywire , Squareup Pte. Ltd, Edenred Payment Solutions , Payoneer Inc. , American Express , Visa Inc. , JPMorgan & Chase, Adyen N.V., Billtrust, Coupa Software Inc., Dwolla, Inc., Earthport PLC, FLEETCOR Technologies, Inc., Intuit Inc., Nvoicepay, Inc., Optal Limited, Paytm Mobile Solutions Private Limited, PayPal Holdings, Inc., TransferWise Ltd. (Now known as Wise), and Scoot and Ride. Growing global B2B e-commerce is driving demand for digital payment solutions among B2B merchants. Technological advancements like real-time payments, artificial intelligence and blockchain are enabling safer and faster B2B payments.

Market Trends

A key trend in the market is the adoption of real-time payments. Countries worldwide are investing in modernizing their legacy payment infrastructures to enable real-time fund transfers and settlements. Another major trend is the shift towards account-to-account payments which eliminate credit card fees and offer better fraud protection.

Market Opportunities

Rising penetration of mobile commerce and investment in payment gateways present lucrative opportunities in the market. Cross-border B2B payments will witness higher growth rates owing to increasing globalization of B2B supply chains. Emerging business models around account payables automation also offer new avenues for payment facilitators in the coming years.

Impact of COVID-19 on B2B Payments Transaction Market

The COVID-19 pandemic has significantly impacted the B2B Payments Transaction Market Size . During the initial lockdown phases across regions, transaction volumes declined sharply as businesses faced disruptions in operations and cash flows. The transition to remote working setups also created operational challenges. However, the market has started recovering strongly post lockdowns driven by increased digital payments adoption among businesses.

Many businesses realized the importance of digital payment systems during the pandemic to provide seamless payment settlements with their ecosystem of suppliers, partners and other stakeholders while maintaining social distancing. Digital payment platforms enabled transactions without any physical contact, reducing health risks. Technologies like mobile wallets, payment apps and APIs emerged as safer and more convenient alternatives than cash-based transactions.

The shift towards online platforms and e-commerce grew manifold during this period. This accelerated the demand for digital B2B payment systems to facilitate transactions across the online supply chains. Several industries also adopted digital procurement systems for the first time, expanding the market opportunities. Overall, despite initial decline, the market is recovering ahead of pre-COVID levels, aided by structural changes in behaviour and increased digitization of business payments.

Going forward, the reliance on digital payments is expected to continue post pandemic. Technologies enabling touchless transactions, data security and enhanced user experience will be critical. Strategic partnerships between FinTechs and traditional players will expand reach into new sectors. Standardization of payment protocols and regulations promoting innovation can further spur growth.

Geographical Concentration of B2B Payments Transaction Market

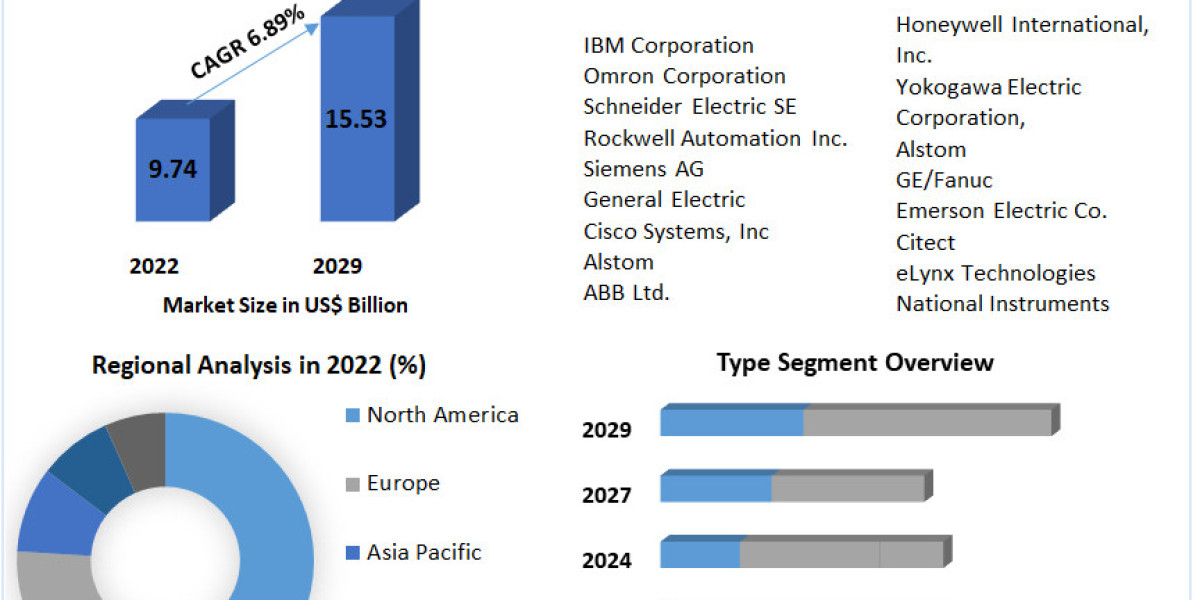

In terms of value, North America holds the largest share of the global B2B payments transaction market currently estimated at around 45%. The presence of major FinTech centres and early adoption of emerging technologies by enterprises have driven higher transaction volumes in the US and Canada. Europe is the second largest region with over 30% market share led by developed markets like the UK, Germany, France contributing significantly.

The Asia Pacific region is witnessed as the fastest growing market for B2B payments globally. Countries like India, China, Indonesia, Philippines and others are witnessing exponential growth in digital transactions post demonetization and policy pushes for financial inclusion. Rapid growth of SMEs, MSMEs, e-commerce platforms as well as startups are accelerating demand. Digital payments adoption is increasing at over 20% annually in the region.

Get more insights on This Topic- B2B Payments Transaction Market