One of the healthiest foods is lupin protein since it includes amino acids. People who appreciate their health also choose it because of its greater protein content. They are also preferred by folks trying to lose weight because of their high fiber content.

See our sample report to learn more about market:

https://www.futuremarketinsights.com/reports/sample/rep-gb-12372

Vegetarianism and veganism are growing in popularity, and plant-based products are being used increasingly often. Customers are starting to buy lupin protein supplements to meet their needs for protein. Consequently, there might be a rise in demand for goods containing lupin protein within the anticipated time frame.

Key Takeaways:

- Market Projection: The lupin protein market is anticipated to grow at a robust 4.9% CAGR from 2023 to 2033, reaching a valuation of USD 159.7 million by 2033, compared to USD 98.8 million in 2023.

- Health Benefits: Recognized as one of the healthiest foods due to its amino acid-rich composition, lupin protein is gaining popularity among health-conscious consumers. Its high protein and fiber content make it a preferred choice for those aiming for weight loss.

- Plant-Based Trend: With the increasing popularity of vegetarianism and veganism, there is a rising demand for plant-based products, leading to a surge in lupin protein supplements to meet protein needs.

- Clean Label Demand: The market witnesses a growing demand for clean-label products, with lupin protein-containing items gaining traction due to clear labeling practices, contributing to market expansion.

- Environmental Sustainability: Lupin protein products are environmentally sustainable, contributing to minimal environmental degradation. The cultivation of lupin seeds requires moderately productive soil, aligning with eco-friendly practices.

Consult with Our Analysts for In-Depth Analysis of the Global Protein Market Trends and Opportunities Across Various Product Types, Nature, End Uses :

https://www.futuremarketinsights.com/checkout/12372

Key Points and Takeaways:

Market Dynamics:

- Gluten-Free Demand: The market for lupin protein products is witnessing growth as a result of increased demand for gluten-free alternatives, positioning lupin protein as a beneficial substitute in gluten-free products.

- Adverse Reactions: Despite its numerous benefits, a few instances of adverse reactions associated with lupin products may pose a limitation to market expansion during the forecast period.

- CAGR Projection: The lupin protein market is projected to grow at a CAGR of 4.9% during the forecast period.

- Market Valuation: Valued at USD 98.8 million in 2023, the market is expected to reach USD 159.7 million by 2033.

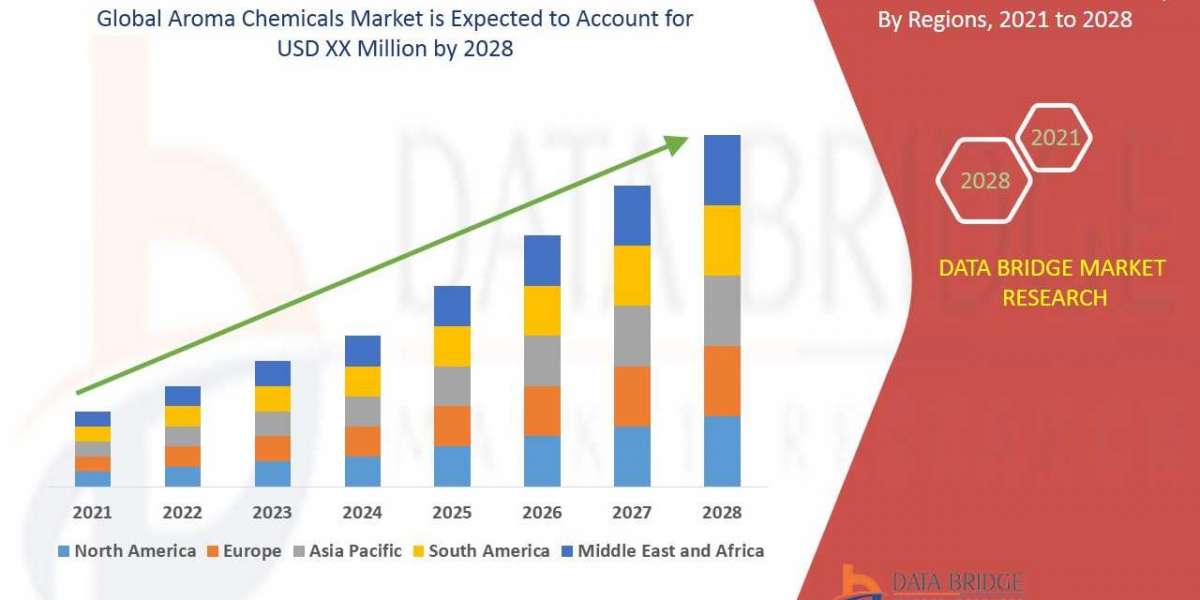

- Regional Growth: Europe is anticipated to be the largest market, with the USA lupin protein market advancing at a CAGR of 6.5%. The UK market is projected to grow at a CAGR of 2.6%, while China, Japan, and South Korea are expected to exhibit significant growth.

- Product Type: Protein isolates are expected to hold the largest market share, growing at a CAGR of 4.6%.

- Nature: Conventional lupin protein products are projected to dominate the market, growing at a CAGR of 4.2%.

In recent years, demand for items with clean labels has skyrocketed. This is a result of consumers’ growing awareness of the value of purchasing genuine goods. Lupine protein-containing products often have clear labelling, which expands their market.

Additionally, using products containing lupin protein ensures little environmental degradation. It eliminates the practise of killing animals for human consumption, which contributes to carbon emissions. Second, lupin seeds can be grown in moderately productive soil. These all suggest that only a small amount of investment will be needed.

Due to the negative effects of consuming gluten, there has recently been an increase in the demand for gluten-free products. Lupin protein products have established themselves as beneficial substitutes for gluten-containing goods, presenting a wide range of business potential.

However, a few instances of adverse reactions have been connected to the use of lupin products. This can limit market expansion during the anticipated period.

Thus, the FMI researchers are of the view that, “the ability to provide requisite levels of protein and fiber, coupled with the increase in the number of vegans and vegetarians, and a plenty of other factors are expected to surge the lupine protein market share during the forecast period.”

Key Takeaways:

- The lupin protein market is projected to grow at a CAGR of 4.9% during the forecast period.

- The market is valued at USD 98.8 million in 2023.

- The market is expected to reach a valuation of USD 159.7 million by 2033.

- As per the regional analysis, Europe is expected to be the largest market during the forecast period.

- USA lupin protein market is expected to advance at a CAGR of 6.5%.

- UK market is projected to grow at a CAGR of 2.6%.

- China market is anticipated to surge at a CAGR of 6.4%.

- Japan lupin protein market is projected to grow at a CAGR of 3.6%.

- South Korea market is expected to grow at a CAGR of 4.9%.

- Based on product type, the protein isolates segment is expected to hold the largest market share, and is anticipated to grow at a CAGR of 4.6%.

- Based on nature, the conventional segment is projected to hold the largest market share, and is expected to grow at a CAGR of 4.2%.

Competitive Landscape:

- Key players in the market, including Cargill, Archer Daniels Midland Company, and Glanbia plc, are investing heavily in technological upgrades and research and development to meet the escalating demand for lupin protein-based products.

- In October 2022, Barentz International acquired Viachem, enhancing its capabilities in the distribution of life science ingredients and specialty chemicals.

Lupin Protein Market Segmentation

By Product Type:

- Protein Isolates,

- Protein Concentrates,

- Flour,

- Other Product Types

By Nature:

- Organic,

- Conventional

By End Use:

- Food Processing (Bakery & Confectionary, Dairy Replacements, Functional Foods, Infant Foods, Meat Alternatives, Other Food Applications),

- Animal Feed (Cattle, Poultry, Swine, Pet Food, Aquafeed),

- Nutraceuticals,

- Sports Nutrition,

- Infant Nutrition

By Processing Type:

- Dry Processing,

- Wet Processing

By Region:

- North America

- Latin America

- Europe

- East Asia

- South Asia

- Oceania

- MEA