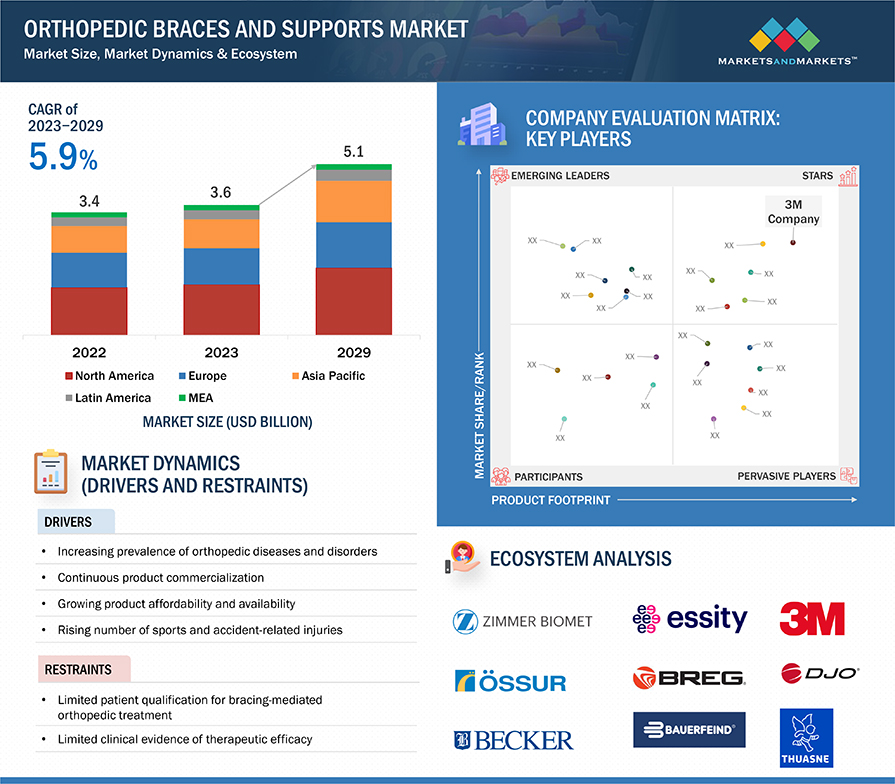

The Global Orthopedic Braces & Supports Market in terms of revenue was estimated to be worth $3.6 billion in 2023 and is poised to reach $5.1 billion by 2029, growing at a CAGR of 5.9% from 2023 to 2029.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=24806829

Browse in-depth TOC on "Orthopedic Braces and Supports Industry"

192 – Tables

47 – Figures

312 – Pages

Product segment to register significant growth rate over the forecast period of 2023-2029.

Based on the product, the global orthopedic braces and supports market is segmented into Knee, Ankle, foot walkers, Hip, Back, and Spine, Shoulder, Elbow, Hand, Wrist Facial braces and supports. The Kness braces and supports segment is anticipated to register the highest growth rate over the forecast period.

Preventive Care segment in application to register significant growth rate over the forecast period of 2023-2029.

Based on application, the global orthopedic braces and supports market is segmented into preventive care, ligament Injury, post-operative rehabilitation, osteoarthritis, compression therapy, Other Application. The growing trend towards proactive health management has led to increased interest in preventive care, including the use of orthopedic braces and supports to address musculoskeletal issues before they escalate. Additionally, as individuals become more health-conscious, there is a rising awareness of the role that orthopedic braces can play in preventing injuries, promoting proper alignment, and supporting overall musculoskeletal well-being.

The hospitals and breast care centers segment accounted for the largest share of the orthopedic braces and supports market, by distribution channel, in 2023.

Based on distribution channel, the orthopedic braces and supports market is segmented into hospitals and surgical centers, orthopedic clinics, pharmacies and retailers, e-commerce platforms and other end users. The hospitals and surgical segment accounts for the largest share of the market in 2022. The increasing prevalence of musculoskeletal disorders and post-surgical rehabilitation needs has fueled the demand for orthopedic braces and supports in hospitals and surgical centers. Additionally, advancements in medical technology and a growing emphasis on non-invasive treatment options contribute to the expanding utilization of orthopedic braces within healthcare settings for comprehensive patient care.

By region, North America is expected to be the largest market of orthopedic braces & supports industry during the forecast period.

North America, comprising the US and Canada, accounted for the largest share of the orthopedic braces & supports market in 2022. The faster growth of the orthopedic braces and supports imaging market in North America can be attributed to its technological leadership, robust healthcare infrastructure, high market demand driven by prevalent diseases and an aging population, ample financial resources for advanced medical equipment investment, established regulatory frameworks ensuring safety and quality, active research collaboration, insurance coverage for advanced diagnostics, patient expectations for comprehensive care, and a competitive market environment fostering innovation.

Request Free Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=24806829

Market Dynamics

Drivers

- Increasing prevalence of orthopedic diseases and disorders

- Continuous product commercialization

- Growing product affordability and availability

- Rising number of sports and accident-related injuries

- Growing public awareness about preventive care

Restraints

- Limited patient qualification for bracing-mediated orthopedic treatment

- Limited clinical evidence of therapeutic efficacy

Opportunities

- Increased sales of off-the-shelf and online products

- Expansion and promotion initiatives by major manufacturers

Challenges

- Significant adoption of pain medication

- Product comfort and compliance

Prominent Players:

3M (US), Essity (Sweden), DJO LLC (US), Ossur HF (Iceland), Breg, Inc. (US), Bauerfeind AG (Germany), Devicor Medical Products, Inc., (Leica Biosystems) (Germany), Hologic, Inc. (US), Argon Medical Devices (US), Zimmer Biomet (US), Ottobock Healthcare (Germany), Thuasne (France), ALCARE Co., Ltd (Japan), Nippon Sigmax (Japan), Bird & Cronin (US), DeRoyal Industries (US), medi GmbH (Germany), and Foundation Wellness (US)

Recent Developments of Orthopedic Braces & Supports Industry:

- In January 2022, Össur announced the launch of the ReLeaf Active knee brace, designed to provide pain relief and support for patients with osteoarthritis. The brace features a unique hinge design that mimics the natural movement of the knee, and it is made from lightweight, breathable materials for comfort.

- In August 2022, DonJoy announced the launch of the Vizor 120 ankle brace, a lightweight and comfortable brace that provides support and stability for patients with ankle sprains. The brace features a unique air-filled pad that conforms to the shape of the ankle, and it is made from breathable materials to keep the foot cool and dry.