India MSME Payment Risk Management Solutions refers to the sharing of technology that provides ease of payment solutions and reduces the chances of deferred payments. Micro Small and Medium Enterprises hold a sizable share in the GDP of the country. These enterprises apart from their high relevance often face difficulty in receiving payments and identifying certain fraudulent customers due to which the requirement for the companies offering various security and payment tracking services has become crucial. In order to address these issues certain centralized systems, blacklist systems, blockchain-based smart contracts, etc., are being implemented which would alleviate the cases of fraudulent activities and help MSMEs to operate smoothly.

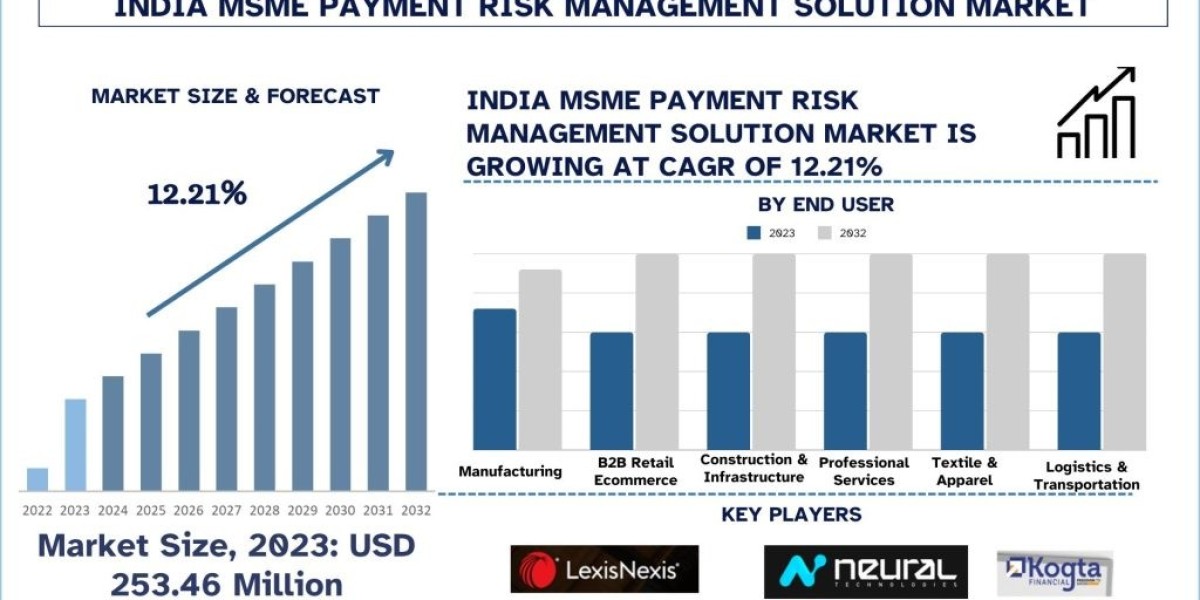

According to the UnivDatos Market Insights Analysis, growing investments in the MSME sector will drive the Indian scenario of the “India MSME Payment Risk Management Solutions Market” report; the market was valued at USD 253.46 million in 2023, growing at a CAGR of 12.21 % during the forecast period from 2024 - 2032.

Request Free Sample Pages with Graphs and Figures Here - https://univdatos.com/get-a-free-sample-form-php/?product_id=67013

MSME Payment Risk Management Solutions Market Overview in North India:

North India region has held a sizable market share in India MSME Payment Risk Management Solution Market. With the increasing number of MSMEs present in the region as well as a high number of investments of the central as well as the state governments towards offering loans to establish micro, small, and medium enterprises in the region the demand for payment-related solutions has extensively grown. Additionally, the region has also experienced a higher demand for e-commerce and manufacturing-related MSME payment solutions. Many of the leading states as Uttar Pradesh, Delhi NCR region, Haryana, etc., have planned to double their GDP in the next five to six years of which the centre of focus is the expansion of MSME industries especially in the manufacturing, e-commerce, and apparel industry.

Considering these shifts the demand for India MSME Payment Risk Management Solutions in the North India region would notably grow. Other regions as West India and South India have also shown significant growth in recent years with the MSME expansion and requirement for payment-related services.

Growing Demand and Industry Trends:

The adoption of blockchain and smart contracts is emerging as a trend among payment risk management solution providers. These technological changes have helped industries such as finance, supply chain, etc., to optimize their payment-related issues. Blockchain technology offers increased efficiency, transparency, and upgraded security solutions. Various benefits such as transparency and trust, enhanced security, increased efficiency, cost reduction, real-time settlement, automation process, etc.

The adoption of blockchain and smart contracts also offers automated payments and settlements once the material/goods are being shipped to the client. The blockchain technology also helps in providing decentralized credit score to the MSMEs to help make them informed decisions. Additionally, these technologies also help to enhance the security of payments.

Related Reports-

AI Data Center Market: Current Analysis and Forecast (2024-2032)

Millimeter Wave Technology Market: Current Analysis and Forecast (2024-2032)

Future Prospects and Opportunities:

As the number of MSMEs in the country is increasing the need for robust centralized systems to identify the defaulters and improve the credit repayments by the customers.

Additionally, the requirement for various types of services such as payment tracking solutions, credit risk assessment tools, fraud detection and prevention software, debt collection solutions, etc., by the MSMEs the demand for payment risk management solutions has increased.

Additionally, with the rising government support in terms of regulatory and monetary assistance, the MSMEs in the country would exponentially grow in the coming years further promoting the need for payment risk management solutions. Furthermore, with the increasing number of MSMEs in the country as well as the increase in the sheer number of payments in the country through MSMEs the demand for reducing delayed payments both intentional and unintentional category would require robust solutions to reduce the payment-related issues.

Considering the changes the demand for MSME payment risk management solutions would further increase during the forecasted year i.e., 2024-2032.

For more information about this report visit- https://univdatos.com/report/india-msme-payment-risk-management-solution-market/

Conclusion:

In conclusion, the North India MSME Payment Risk Management Solutions market reflects a dynamic and evolving landscape supported by government investment, industry collaboration, and technological innovation. As the region continues strengthening its GDP growth through the development of MSMEs through extensive investment, regulatory support, and strategic partnerships, it is well-positioned to navigate challenges and capitalize on emerging opportunities in the debt collection industry.