The Evolution of White Label Futures Trading Software

Before discussing low entry barriers, it would be quite interesting to know what the term white label futures trading software means. This software allows enterprises to provide futures trading services without paying stress on developing the relevant software from scratch. That is, “white label” refers to the service being available for resale by a company after rebranding it as if it were the firm’s product, so startups don’t need to trouble themselves with technical development but instead brand and acquire customers.

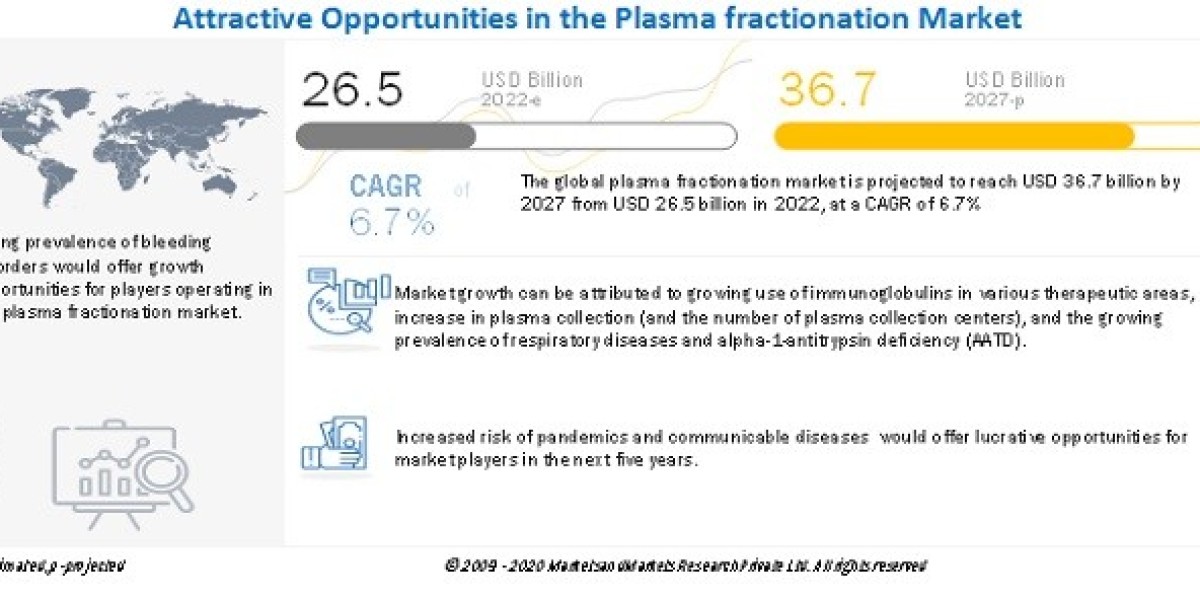

Futures trading is basically the trading of contracts agreeing on buying or selling an asset at some future date for some particular price. It’s a market experiencing exponential growth based both on individual and institutional trading, which has sought to hedge against risks or speculate over pricing changes. The easy availability of a customizable and feature-rich trading platform provides a lucrative opportunity for any startup to make the market entry with utter confidence, and that too at an extraordinarily fast pace.

In 2025, we’re seeing a new generation of white label platforms that offer:

- Cloud-based infrastructures

- Modular architectures

- Advanced APIs for seamless integration

- User-friendly customization tools

- Built-in regulatory compliance features

Customizing a white label futures trading software significantly reduces the technical and financial threshold to enter, thus opening the floodgates for even resource-poorer startups launching trade platforms.

Entry Barriers: Important Factors

1. Customization of Low-Code and No-Code

By 2025, white label solution providers offer intuitive drag-and-drop interfaces and visual editors through which non-technical users can personalize their trading platforms. Accordingly, no deep knowledge of coding is needed nor a large team of developers, thus reducing both time-to-market and operational costs significantly.

2. AI-Powered Risk Management

With artificial intelligence, the whole idea of risk management in futures trading has been furthered. White label futures trading software, now, comes preloaded with AI algorithms capable of analyzing market trends and assessing trader behavior to auto-implement risk mitigation strategies. Such sophistication was once the privilege of large institutions alone and is now accessible to start-ups and has leveled the playing field.

3. Blockchain Integration

Integration of blockchain technology into the white label futures trading software has found ways to resolve several issues related to trust and transparency. This has prevented many potential entrants into the market. Smart contracts can even automate trade execution and settlement through fewer intermediaries and at lower operational costs.

4. Regulatory Technology (RegTech) Solutions

Compliance has always been one of the major challenges faced by trading start-ups, but the latest white label platforms feature built-in RegTech solutions for automating the compliance process, not only in the KYC/AML checks but also in transaction monitoring. It significantly reduces the regulatory burden for start-ups to focus on their core business activity.

Read More >>> https://www.antiersolutions.com/reduce-startup-barriers-with-white-label-futures-trading-software-in-2025/