How to day trade forex: Introduction and strategy

Forex day trading is a popular way of trading currencies on the shorter timeframe charts. Read on for more about day trading forex, how to apply it to a strategy, and managing their risk effectively.To get more news about Forex Day Trading, you can visit wikifx.com official website.

What is forex day trading?

Forex day trading is a way to trade currencies on an intraday basis, using shorter-term charts (for example, 15-minute charts). Traders will manage positions over a matter of minutes to hours, often with the assistance of technical tools that can assist with entry and exit points. It’s a way of trading that requires focus and discipline in fast-changing markets.

The timeframe for a day trader is shorter than that of a position trader, who will keep their trade open for several months up to even a year, or a swing trader whose position may last for a few weeks. However, it is longer than a scalper, who will be exiting a trade within minutes, or even seconds.

Forex vs stocks day trading

When it comes to forex vs stocks for day trading, there are many differences for traders to consider. Here’s a big one: with markets such as stocks, since a day trader’s positions will not be held overnight, they usually are not affected by fundamental occurrences like specific news events that can hit prices before the market opens or after it closes.

But since forex is a 24-hour market, fundamentals can affect price action at any given time, and traders should be mindful of this if following a purely technical approach.

There are other key factors that differentiate day trading forex with day trading stocks and other markets, involving leverage levels, trading volume, accessibility, and more. Here are some other general differences between forex day trading and stocks day trading for US traders.

How to start day trading forex

In order to start day trading forex, people must first understand that this is a challenging endeavor that requires meticulous preparation. To have a chance of profitability, traders must be aware of the combination of fundamental and technical drivers of currency markets, as mentioned. But they must also start with sufficient capital in order not to bust their account. Forex Trading is not suitable for all investors

This may vary from person to person, but while a few hundred dollars may be sufficient to merely experiment with a real money account, a large account size may give a better opportunity that will sufficiently compensate the time invested.

Traders also need to ensure that they will be able to access the charts for the entirety of the time they plan to spend trading per day. An unexpected trip away from the computer or mobile, no matter how quick, could mean vital information on price action is missed.

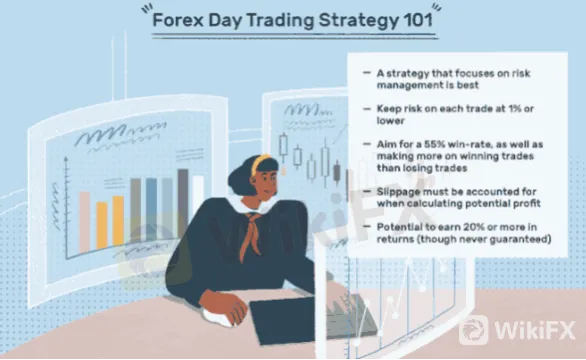

Crucially, traders need to understand the risks involved and ensure they employ a risk management strategy to protect them as best they can. This means not trading more than a fixed percentage (perhaps 1 or 2%) of their available capital per day, starting small, applying well-thought-out stops and limits, and sticking to a strategy.

A successful forex day trading strategy may involve up to around five trades throughout the day, with each lasting from a few minutes to a few hours. There are a great many strategies available but, whatever the approach, day traders should generally look to trade at the most liquid times, around 8AM-12PM ET, when the US/London markets overlap.

Prior to opening a position, it’s essential to identify the market conditions in which a strategy will be played out, as multiple timeframe analysis can give the bigger picture of price action. In the below example, 20 and 50-period EMAs are used on a one-hour chart to ascertain a wider trend, with the intention to open and close positions on a 15-minute chart.

For the below example, we’ll look at a simple moving average crossover strategy. A trader may choose longs when the 9-period EMA crosses above the 21-period EMA, and when price is above the 200-period EMA. Conversely, shorts may be taken when the 9-period EMA crosses below the 21-period EMA, and when price drops below the 200-period EMA.

Here, a long green candle completes above the 200-period EMA, coinciding with a bullish EMA crossover, making it a reasonable entry choice long.

In this case, a tight stop may be placed just beneath the crossover, while a more aggressive choice of stop placement would be further down at the recent swing low. However, a stop that is too tight may exit a trade prematurely, while losses may mount quickly if a stop is too far away. With time, traders can find the balance that works for their style.