The Asia Pacific market is mainly driven by the overall growth of the medical devices market, mainly due to the rising disease prevalence, life expectancy, and geriatric population. Technological advancements have prompted end users to overhaul or update their manufacturing systems. As this is a costly process, they look to outsource contract manufacturing. However, market growth is impeded by the growing consolidation in the medical devices market. To develop their own manufacturing capabilities and save costs, Larger players are focusing on acquiring smaller players and CMOs themselves. This may affect the overall market growth to a certain extent.

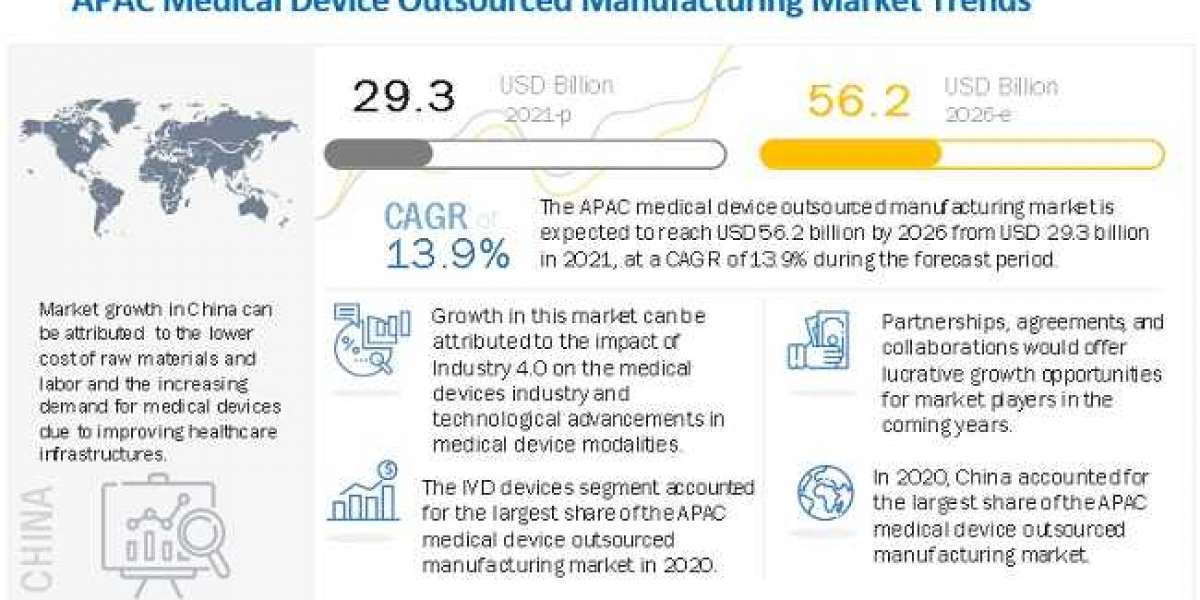

The Medical Device Outsourced Manufacturing Market is projected to reach USD 56.2 billion by 2026 from USD 29.3 billion in 2021 and is expected to grow at a CAGR of 13.9% during the forecast period.

Browse in-depth TOC on "Medical Device Outsourced Manufacturing Market"

200 – Tables

61 – Figures

306 – Pages

Download PDF Brochure:-https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=477468

The IVD devices segment accounted for the largest share of Asia Pacific medical device outsourced manufacturing market in 2020

Based on device type, the Asia Pacific market is broadly segmented into IVD devices, diagnostic imaging devices, cardiovascular devices, drug delivery devices, orthopedic devices, respiratory care devices, ophthalmology devices, surgical devices, diabetes care devices, dental devices, endoscopy devices, gynecology/urology devices, personal care devices, neurology devices, and other devices. In 2020, the IVD devices segment accounted for the largest share of the Asia Pacific market. The large share of this segment can be attributed to the increasing volume of IVD tests performed globally, increasing availability of IVD kits and reagents in the market, a growing number of hospitals and clinical laboratories in developing countries, automation and technological advancements in instruments with high-throughput capabilities, high demand for IVD tests in the COVID-19 pandemic, and advances in life science research.

Class II medical devices segment accounted for the largest share of APAC market in 2020.

Based on the class of device, the medical device outsourced manufacturing market is segmented into Class I, Class II, and Class III medical devices. In 2020, the Class II medical devices segment accounted for the largest share of the Asia Pacific market. The large share of this segment can be attributed to the large number of medical devices outsourced that fall under this device class and the utilization of a higher volume of these devices by end users and caregivers in the healthcare industry.

In 2020, device development and manufacturing services segment accounted for the largest share of the Asia Pacific market

Based on service, the Asia Pacific medical device outsourced manufacturing market is segmented into device development and manufacturing services, quality management services, packaging and assembly services and other services. In 2020, the device development and manufacturing services segment dominated this market. The increasing adoption of contract manufacturing services in the medical device industry, growth in the medical devices market (especially in the single-use disposable medical devices market), and improving device development and manufacturing capabilities are the major factors responsible for the large share of this segment.

Request for Sample Pages:- https://www.marketsandmarkets.com/requestsampleNew.asp?id=477468

In 2020, production segment accounted for the largest share of Asia Pacific medical device outsourced manufacturing market

Based on process, the Asia Pacific market is broadly segmented into production, prototyping, pilot production, design for manufacturing, process evaluation, validation, project management, packaging, and assembly. In 2020, the production segment accounted for the largest share of the market. The large share of this segment can be attributed to the growing number of medical device companies outsourcing their production tasks to minimize manufacturing costs.

China is expected to witness fastest growth during the forecast period of 2021–2026.

The Asia Pacific medical device outsourced manufacturing market, by country, has been segmented into China, Japan, Malaysia Singapore, India, Australia New Zealand, South Korea, and the Rest of APAC. China is expected to witness fastest growth during the forecast period of 2021–2026. China's fastest growth is mainly due to the lower cost of raw materials and labor in the country than in developed countries. The increasing demand for medical devices due to improving healthcare infrastructures, adoption of technologically advanced products, and increasing awareness of diagnosis are also expected to drive the growth of this market.

The prominent players in this medical device outsourced manufacturing market are Flex, Ltd. (Singapore), Jabil, Inc. (US), TE Connectivity, Ltd. (Switzerland), Sanmina Corporation (US), Nipro Corporation (Japan), Celestica International (Canada), Plexus Corporation (US), Benchmark Electronics, Inc. (US), Integer Holdings Corporation (US), Gerresheimer Ag (Germany), West Pharmaceutical Services, Inc. (US), Nortech Systems, Inc. (US), Consort Medical PLC (UK), Kimball Electronics Inc. (US), and Teleflex Incorporated (US), Nordson Corporation (US), Tecomet, Inc. (US), SMC Ltd. (US), Nemera (France), and Tessy Plastics Corporation (US), among others.