The cell culture market is booming, as more and more industries are investing in the research and development of cell culture technologies. Cell cultures are used in a variety of applications, from drug development to tissue engineering, and the market for cell culture products is growing around the world.

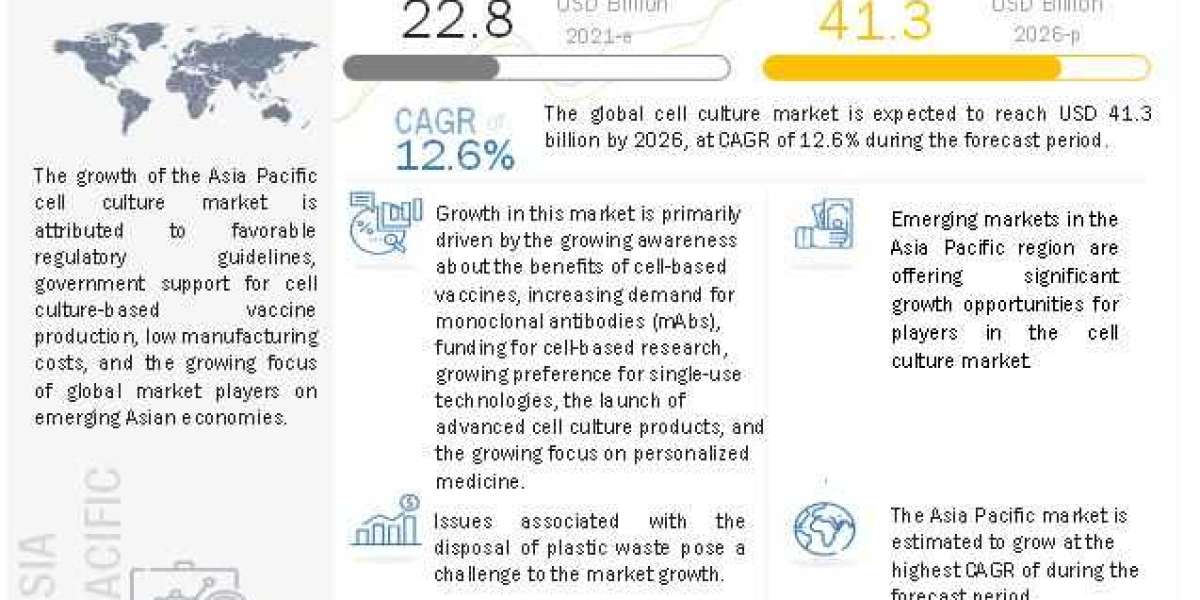

Cell Culture Market is projected to reach USD 41.3 billion by 2026 from USD 22.8 billion in 2021, at a CAGR of 12.6 % between 2021 and 2026. The growth of this market is majorly driven by the growing awareness about the benefits of cell-based vaccines, increasing demand for monoclonal antibodies (mAbs), funding for cell-based research, growing preference for single-use technologies, the launch of advanced cell culture products, and the growing focus on personalized medicine. On the other hand, the high cost of cell biology research is restraining the growth of this market.

Cell cultures are used to grow cells in a controlled environment, typically outside of the body. This allows for more precise experimentation and more accurate results. Cell culture products include media, reagents, culture systems, and more, and the market for these products is expected to continue to grow as more companies invest in cell culture research and development.

Request for assumptions how numbers were triangulated.

https://www.marketsandmarkets.com/requestsampleNew.asp?id=559

Drivers: Growing awareness about the benefits of cell-based vaccines

The growth in population, climate change, and increasing contact between humans and animals have increased the threat of new virus outbreaks. Influenza and COVID-19, for example, have proven unpredictable and recurring events that pose a significant economic and social burden. As of February 4, 2022, 386.55 million cases of COVID-19 were confirmed globally, including 5.71 million deaths, by the WHO. The increasing incidence of infectious diseases and the growing risk of pandemics are expected to drive vaccine demand worldwide. In the pharmaceutical industry, cell culture has become a prominent part of vaccine production. The cell culture technology has been used to produce vaccines for rotavirus, polio, smallpox, hepatitis, rubella, and chickenpox. Cell-based flu vaccines have also been approved for use in the US and many European countries. Increasing awareness of the benefits of cell culture-based vaccines, coupled with the regulatory approval of several cell culture-based vaccines worldwide, are the major factors that are expected to support the growth of the cell culture market during the forecast period.

Opportunities: Growing demand for 3D cell culture

3D cell cultures are gaining demand over 2D cell cultures due to multiple reasons. 2D cell culture methods involve growing cells on flat surfaces as 2D monolayers. However, these cells adhere only to cell culture vessels and attach only to cells at the periphery; this limits multi-dimensional cell cultures. Researchers have come up with 3D cell cultures to resolve these issues. These cultures have proven to be efficient in several studies of basic biological mechanisms, such as cell number monitoring, cell viability, cell proliferation, and cell morphology. Moreover, 3D cell cultures have greater stability and longer lifespans as compared to 2D cultures. The benefits of 3D cell cultures have attracted several players to invest in this field. In June 2020, Lonza and CELLINK collaborated to offer a 3D bioprinting solution designed to advance complete 3D cell culture workflows.

The global cell culture market is a consolidated market, with Thermo Fisher Scientific, Inc. (US), Merck KGaA (Germany), Danaher Corporation (US), Sartorius AG (Germany) together accounting for ~60–65% of the global market.

Download an Illustrative Overview:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=559

Cell culture products are becoming increasingly important in the medical field, as they are used to study diseases, develop treatments, and even create new organs. Cell cultures are also used in the food industry to study the effects of different ingredients and to improve food safety.

Cell culture products are also important in the cosmetics industry, as they are used to study the effects of different compounds on skin cells. Cell cultures are also used in the biotech industry to develop new drugs and treatments.

As the demand for cell culture products continues to grow, the market is expected to see significant growth in the coming years. Companies that specialize in cell culture products are working to develop new products and technologies that can be used in a variety of industries. As the cell culture market continues to grow, more businesses are likely to invest in this technology and develop new products to meet the demand from consumers.

Recent Developments:

- In October 2021, Thermo Fisher Scientific Inc. (US) launched the Gibco Cell Therapy Systems (CTS) NK-Xpander Medium, which supports the large-scale growth and culture of functional natural killer (NK) cells with or without the use of feeder cells.

- In September 2021, Cytiva expanded its manufacturing capacity for bioprocessing single-use consumables by launching 3 new manufacturing facilities in under ten months.

Content Source:

https://www.marketsandmarkets.com/Market-Reports/cell-culture-market-media-sera-reagents-559.html