A payroll is a list of employees of a firm who are entitled to salary as well as other work perks, as well as the amounts that each should get. Along with the amounts that each employee should earn for hours spent or activities completed, such as salary and wages, bonuses, withholding taxes, or the company’s compensation department. A business can manage all components of the payroll process in-house or outsource them to a payroll processing provider. Often HR and Accounting departments handle this procedure. Manual payroll processing is usually a time-consuming operation. Hence good Payroll software is a must-have tool for managing all of the intricate procedures.

Payroll software

Payroll software is an on-premise or cloud-based system for managing, maintaining, and automating employee payments. These softwares that is robust, integrated, and correctly designed may assist firms of all sizes. They help in maintaining compliance with tax laws and other financial rules while also reducing expenses. This liberates human resources (HR) teams from regular chores. Additionally, allows them to devote more time to strategic planning, budgeting, and other business-forward efforts.

Payroll software switch

The end of the quarter or the end of the year is the optimal time to transfer payroll providers.

At the end of the year, you might start again by getting ready to onboard a new payroll provider. It also eliminates the need to record employee salaries from the prior year, which saves a significant amount of time, especially for smaller businesses. When you move providers at the end of the quarter, you’ll still need to transfer previous employee data, but you’ll also have the added benefit of processing and reporting taxes for the following quarter with your new provider.

While you may switch payroll suppliers at any time, it is best to plan ahead of time to ensure a smooth transition.

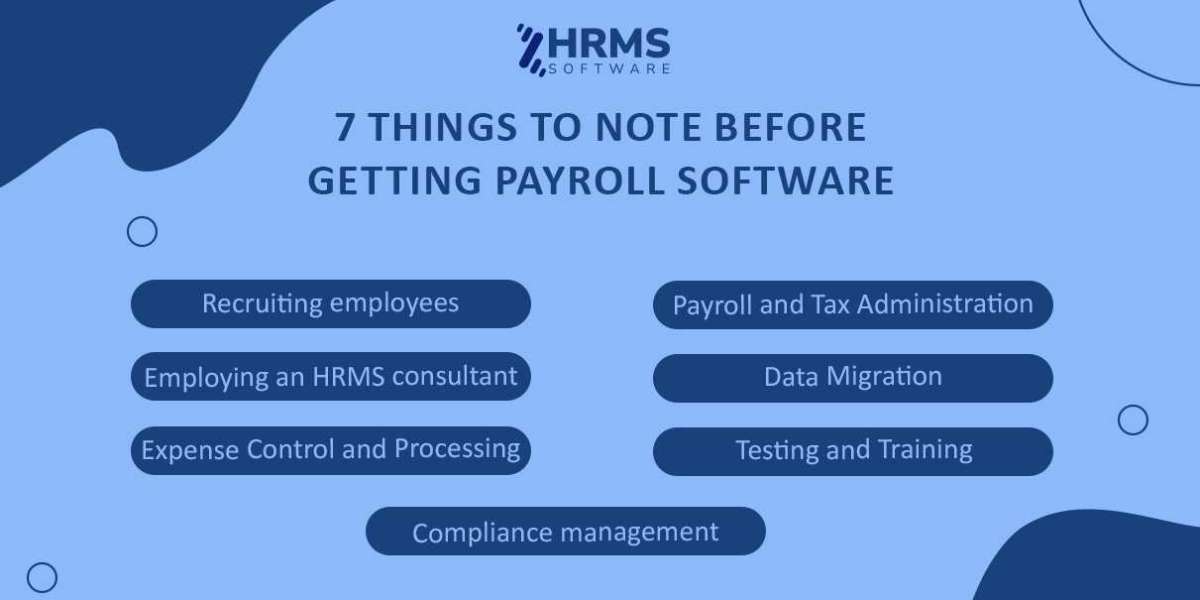

7 things to note before getting payroll software

Recruiting employees

Nothing is more beneficial than an enthusiastic employee who is eager to implement a new system. They may have even proposed the notion of relocating payroll software Dubai. Also, Payroll software Dubai tries to understand its limits better than management. Often, the person in charge will seek better ways to manage their workflow. Moreover, will be the one who is aware of the greatest possibilities accessible.

Employing an HRMS consultant

First, determine whether a consultant is required. You should think about engaging an outside consultant for Payroll software Dubai for the following reasons:

- If employee surveys show that HR is underperforming or is seen to be sluggish and insensitive.

- If you’re planning a significant change to your present HR systems and practices.

- If there are significant conflicts of opinion among prominent players.

When you’ve determined that you need an expert to help you choose and/or execute your new HR technology, seek a reputable HRMS payroll software UAE consultant that you believe has the essential abilities and a thorough grasp of the HRMS payroll software Dubai industry. Other factors to consider for Payroll software UAE include their ability to develop relationships with top executives and their possible cultural fit inside your firm.

Expense Control and Processing

The goal of payroll software UAE, administration, and processing technologies is to properly reward employees. Payment methods, both digital and physical, must be processed on a daily, weekly, or monthly basis.

Payroll software Dubai suites often provide for bonuses, deductions, and 401(k) and insurance payments. Some system visualisations reveal information about a company’s procedures. These insights may be used by a company to update policies over time and track the success of policy changes.

Payroll and Tax Administration

Payroll software Dubai accurately calculates payment deductions and taxes on financial transactions. With compliance management capabilities. Payroll software UAE manages the full tax form completion and filing procedure, either digitally or with the assistance of support.

Data Migration

When moving data from your historical HRMS payroll software Dubai to your new system, you must first determine your method. First, go over your present data to discover gaps and ensure its correctness for Payroll Software Dubai. Check everyone’s personal information as part of the stakeholder engagement activity. Security should be at the top of your priority list, especially if your new HRMS payroll software UAE is cloud-based.

Testing and Training

When establishing a new HRMS, testing is a must. As a starting point for test scripts, consider the employee lifetime. Processes frequently fail, necessitating another round of testing. Retest the faulty component just until it passes, then run it through your end-to-end testing methods to ensure everything is operating properly.

An HRMS installation project might fail due to poor user uptake. Connecting your user-training strategy to broader corporate objectives such as cost reduction, greater employee happiness, improved reputation, and improved legislation compliance will keep you on track.

Compliance management

The Payroll software UAE, should adhere to the labor law compliance features, and it should be capable of monitoring local, federal, and worldwide standards to verify that each process adheres to the relevant laws and regulations of that country. The system must accommodate the many tax services that your company demands. Furthermore, the system has the ability to determine the country’s pay components. It should also support the country’s tax laws as well as local norms and regulations.

Payroll Software UAE

Emerald Software’s all-in-one payroll solution automates and streamlines timekeeping and expenditure management, removing the need for time-consuming spreadsheets and providing employees with a dependable experience.

HRMS payroll software UAE manages activities such as employee monitoring, application tracking, performance reviews, benefits administration, payroll systems, and time and attendance, among others. We provide the best HR and payroll software Dubai.

We customise HR and payroll software UAE to your company’s needs. Depending on the versions selected, the HRMS Payroll software Dubai provides may assist customers with all of their basic and even sophisticated company requirements.