T-REX - Wholesale Markets Review

Amongst a myriad of other changes, MIFID II brought various repercussions for the operation of dark trading venues (i.e. venues where you can’t see the executable price before trading). Tight restrictions on the use of pre-trade transparency waivers (waivers) combined with a requirement to execute algorithmic order flow ‘on venue’ prevented the operation of so-called broker crossing networks (BCNs) and limited the amount of dark trading occurring on venues via a double volume cap (DVC) mechanism. To the seasoned observer the stated goal of preventing a deterioration of lit trading books (caused by order flow moving away from lit venues) seemed to be driven by principle rather than analysis.To get more news about trex markets review, you can visit wikifx.com official website.

Brexit affects

The Treasury, following Brexit, is now recommending the removal of these double volume caps for venues which operate in the UK. This is good news for investors who interact with dark venues in order to reduce their trading cost (mid-spread price improvement and lower price impact). Dark trading in UK stocks is currently around 13% speaking to exchanges and larger venue operators. We hypothesise that this could increase to more than 20% during the coming 12 months.

In contrast, the European Commission has proposed tightening the volume cap on dark trading in EU venues by reducing the threshold after which dark trading is banned from 8% to 7%. There is a European parliamentary vote scheduled for Q4 2022 to pass this into law.

The Honeypot effect – flow attracts flow

With the expected increase in activity on UK dark venues (including for EU stocks) we expect to see a related increase in firms integrating dark liquidity into their execution process.

Over the next 24 months we would expect to see more and more trades i) check dark mid-price venues to get price improvement (especially from retail intermediaries), ii) cluster into dark venues to get a “fairer” price earlier in an order’s life, iii) rest orders for longer to avoid adverse signalling before trading and adverse price reversion after trading and iv) go to venues that can permit “member matching” so that retail flow can be subsumed into an easily digestible trading opportunity for all market participants.

Anecdotally institutions relish the opportunity to face retail flow at mid price in a member matched way, much like used to happen in now defunct Broker Crossing Networks.

Retail use institutional tools

Institutional users are used to consuming electronic executions via an SOR (Smart Order Router). Execution approaches continue to evolve as execution wheels become more common. These wheels help enable the automated use of broker algorithms and allow for greater precision when monitoring execution quality such as execution price vs arrival or deviation from VWAP.

As a result of the FCA platforms paper and the wholesale market review we now see retail brokers and wealth managers start to adopt institutional technology solutions, as an addition to their use of the Retail Service Provider (RSP) network, akin to the electronic adoption of institutional managers. There are a number of LSE member firms who provide two ways prices during market hours (market makers), overlaid with a smaller network of RSP firms who typically can offer small price improvements to improve on that quote. Retail intermediaries typically have 15 to 30 seconds to accept an RSP quote, and more are now opting in to an “all or nothing” T-REX order type to be able to trade, at mids, prior to accepting that quote (which is a quick 3 second binomial outcome).

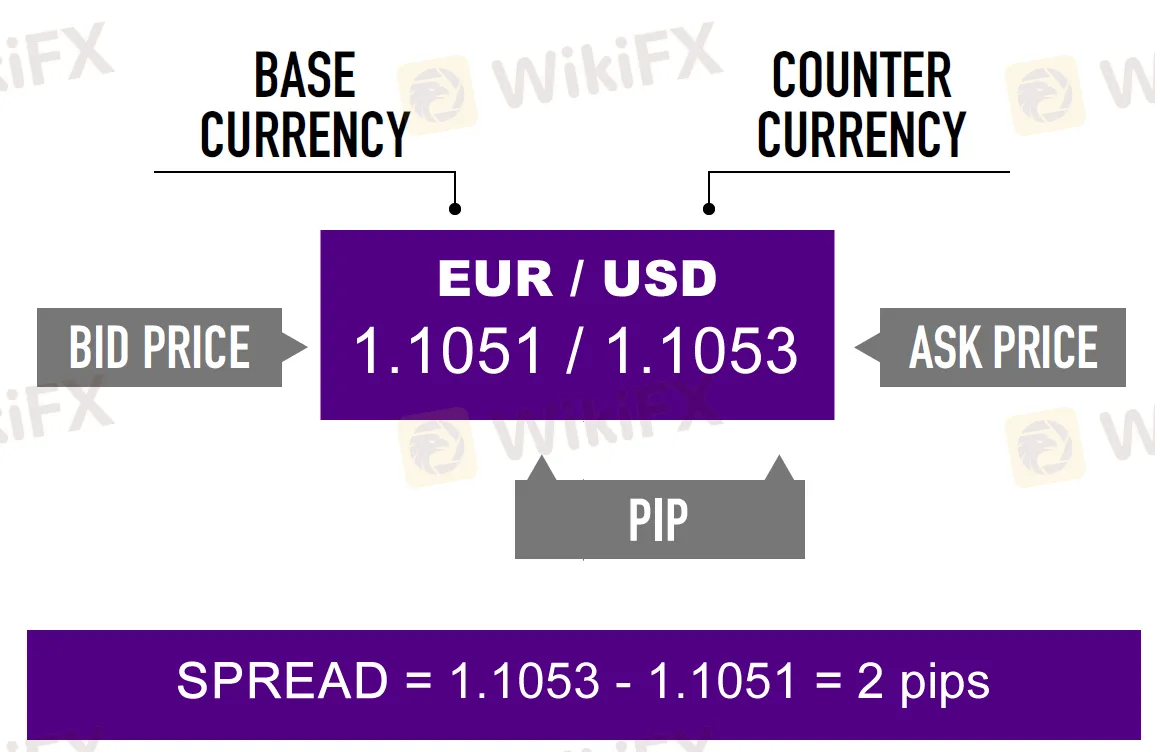

This adoption of advanced execution capabilities is driven by a need to poll alternative trading venues systematically rather than always rely on a one hit OTC RSP price which can be outside the bid offer spread, and to offer institutional trading tools to retail end users as well as central dealing desks. Metrics for analysing execution of retail orders can flow differ from institutional measures. The focus for retail is generally the improvement that can be obtained vs the RSP price or the lit market touch. The adoption of technology diminishes the importance of considering execution likelihood for alternative execution channels as midpoint venue access via tools like T-Rex can be incorporated without negatively impacting the process around RSP execution practices.

Return of the Crossing Network

In the UK the FCA intends to allow order flow matching in Systematic Internalisers (SIs) at mid-price, in any size. This might have ramifications for some periodic auction mechanisms that had, almost exclusively, been allowed to do this. These venues have the benefit of being lit venues, visible to algorithmic traders, but invisible to the naked eye. As lit markets, activity in periodic auctions is not restricted by MiFID II’s dark caps. These venues also enabled “member matching” where orders from a single broker would trade against other orders from that broker before interacting with the rest of the market.

Whilst this may have seemed like an uneven playing field, allowing trading at mid-price (in periodic auctions and latterly in SIs) with a transparent and orderly lit market providing the reference price allows efficient trading at a fair price. The operation of such venues requires a decent amount of “touch liquidity” to give price formation for this kind of trading. We expect that over the next 12 months most dark aggregators, such as T-REX, would expect to take advantage of using more of these style of venues to uncover extra liquidity i.e. extra chances for all types of end investors to trade at mid price.