Algorithm Trading Market Research Report’, the report is complete with an elaborate research undertaken by prominent analysts and a detailed analysis of the global industry place. Moreover, it projects the consumption of submarkets with respect to key regions (along with their respective key countries). This market document also analyzes competitive developments such as expansions, agreements, new product launches, and acquisitions in the market. It strategically profiles the key players and comprehensively analyzes their growth strategies. Algorithm Trading business analysis report is the perfect market research study which helps clients to map their needs. The data and information concerning industry is derived from consistent sources such as websites, annual reports of the companies, journals, and others and were checked and validated by the market experts.

Algorithm Trading market analysis document is represented in a proper way with the help of graphs, tables, and charts which gives best user experience and understanding. The industry analysis report is truly a key to achieve the new horizon of success. This market research report gives thorough idea about the current scenario of the global market, recent developments, product launches, joint ventures, capacity, production value, mergers and acquisitions based on several market dynamics. The universal Algorithm Trading business research report is highly beneficial in planning of production, product launches, costing, inventory, purchasing, and marketing strategies.

Click to get Global Algorithm Trading Market Research Sample PDF Copy Instantly @ https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-algorithm-trading-market

The algorithm trading market is expected to witness market growth at a rate of 12.10% in the forecast period of 2021 to 2028. Data Bridge Market Research report on algorithm trading market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecast period while providing their impacts on the market’s growth. The rise in demand for demand for market surveillance is escalating the growth of algorithm trading market.

“Product definition”

Algorithm trading is used to analyze every quote and trade in the stock market making use of predefined rules, back tested and placed at predefined levels. They assist in detecting opportunities for liquidity by turning knowledge into smart trading decisions. Cloud-based algorithmic trading platforms are highly being deployed as they offer maximum profit gains as these systems help traders automate their trading processes.

Competitive Landscape

The algorithm trading market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies’ focus related to algorithm trading market.

Future Outlook and by Top key players Analysis

The major players covered in the algorithm trading market report are Thomson Reuters, 63 moons technologies limited, VIRTU Financial Inc., Software AG, MetaQuotes Ltd, Symphony Limited, InfoReach, Inc., Argo Software Engineering, Kuberre Systems, Inc., Tata Consultancy Services Limited, QuantCore Capital Management, LLC, iRageCapital, Automated Trading Softtech Pvt. Ltd., Trading Technologies International, Inc, uTrade., Vela Labs, Inc., AlgoTrader among other

Global Algorithm Trading Market: Segment Analysis

By Components (Solutions, Services),

Trading Types (Foreign Exchange (FOREX), Stock Markets, Exchange-Traded Fund (ETF), Bonds, Cryptocurrencies, Others),

Deployment Modes (On-premises, Cloud),

Enterprise Size (Small and Medium-Sized Enterprises (SMEs), Large Enterprises),

Global Algorithm Trading Market Country Level Analysis

The algorithm trading market is analyzed and market size, volume information is provided by country, components, trading types, deployment modes and enterprise size as referenced above.

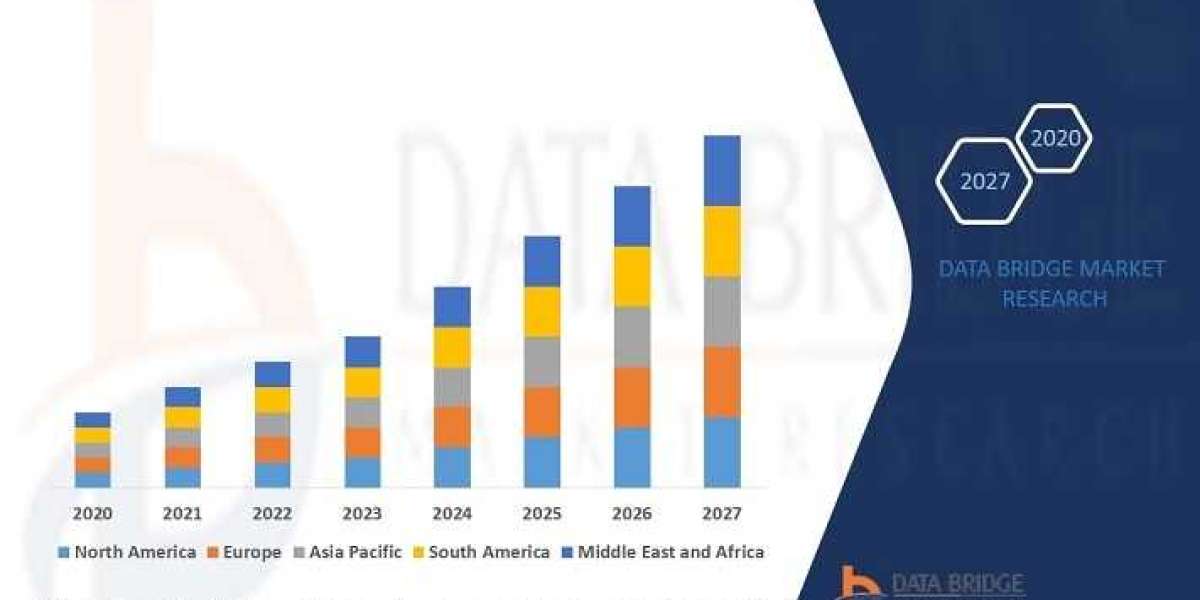

The countries covered in the global algorithm trading market report are the U.S., Canada and Mexico in North America, Brazil, Argentina and Rest of South America as part of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America dominates the algorithm trading market due to the rise in investments in trading technologies such as blockchain, government support for global trading, technological advancements, presence of algorithmic trading vendors and high usage various applications such as banks and financial institutions.

Algorithm Trading Market Scope and Market Size

The algorithm trading market is segmented on the basis of components, trading types, deployment modes and enterprise size. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of components, the algorithm trading market is segmented into solutions and services. Solutions are further segmented into platforms and software tools. Services are further segmented into professional services and managed services.

- On the basis of trading types, the algorithm trading market is segmented into foreign exchange (FOREX), stock markets, exchange-traded fund (ETF), bonds, cryptocurrencies and others. Others are further segmented into commodities, assets, credit default swaps, (CDS), interest rate swaps (IRS) and collateral mortgage.

- On the basis of deployment type, the algorithm trading market is segmented into on-premises and cloud.

- On the basis of enterprise size, the algorithm trading market is segmented into small and medium-sized enterprises (SMEs) and large enterprises.

Key Highlights from Algorithm Trading Market Study.

Revenue and Sales Estimation — Historical Revenue and sales volume is presented and further data is triangulated with top-down and bottom-up approaches to forecast complete market size and to estimate forecast numbers for key regions covered in the report along with classified and well recognized Types and end-use industry. Additionally macroeconomic factor and regulatory policies are ascertained in Algorithm Trading industry evolution and predictive analysis.

Manufacturing Analysis —the report is currently analyzed concerning various product type and application. The Algorithm Trading market provides a chapter highlighting manufacturing process analysis validated via primary information collected through Industry experts and Key officials of profiled companies.

Competition — Leading players have been studied depending on their company profile, product portfolio, capacity, product/service price, sales, and cost/profit.

Demand Supply and Effectiveness — Algorithm Trading report additionally provides distribution, Production, Consumption EXIM** (Export Import). ** If applicable

Know More Business Opportunities In Global Algorithm Trading Market. Speak To Our Analyst And Gain Crucial Industry Insights That Will Help Your Business Expand Request Analyst Call On @ https://www.databridgemarketresearch.com/inquire-before-buying/?dbmr=global-algorithm-trading-market

In addition, the years considered for the study are as follows:

Historical year – 2015-2020 | Base year – 2020 | Forecast period – 2022 to 2029

WHO SHOULD BUY THE GLOBAL ALGORITHM TRADING REPORT?

People looking to enrich the decision-making capability by following points must buy the report:

- Breakdown of market share of the top Algorithm Trading industry players

- Evaluations of market share for the regional and country level sectors

- Estimation of Algorithm Trading market for the forecast period of all the aforementioned classes, sub classes, and the domestic markets

- Tactical recommendation for the newbies

- Tactical recommendation in primary business industries based on the Algorithm Trading market forecast

Table of Content: Global Algorithm Trading Market Research Report 2022-2029

Chapter 1: Algorithm Trading Market Overview

Chapter 2: Algorithm Trading Market Economic Impact

Chapter 3: Competition by Manufacturer

Chapter 4: Production, Revenue (Value) by Region (2022-2029)

Chapter 5: Supply (Production), Consumption, Export, Import by Regions (2022-2029)

Chapter 6: Production, Revenue (Value), Price Trend by Type

Chapter 7: Algorithm Trading Market Analysis by Application

Chapter 8: Algorithm Trading Market by Manufacturing Cost Analysis

Chapter 9: Industrial Chain, Sourcing Strategy and Downstream Buyers

Chapter 10: Algorithm Trading Marketing Strategy Analysis, Distributors/Traders

Chapter 11: Algorithm Trading Market Effect Factors Analysis

Chapter 12: Algorithm Trading Market Forecast (2022-2029)

Chapter 13: Appendix

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe, MEA or Asia Pacific.

New Business Strategies, Challenges Policies are mentioned in Table of Content, Request TOC @ https://www.databridgemarketresearch.com/toc/?dbmr=global-algorithm-trading-market

Our report offers the following data from 2022 to 2029:–

– Algorithm Trading Market share assessments for the regional and country level segments.

– Market share analysis of the top industry players.

– Market forecasts for a minimum of 9 years of all the mentioned segments, sub segments and the regional markets.

–Algorithm Trading Market Trends (Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and recommendations).

– Strategic recommendations in key business segments based on the market estimations.

– Competitive landscaping mapping the key common trends.

– Company profiling with detailed strategies, financials, and recent developments.

–Algorithm Trading Industry Supply chain trends mapping the latest technological advancements.

Key questions answered in the Global Algorithm Trading Market report include:

- What will be Algorithm Trading market share and the forecast for 2022-2029?

- What are the key factors compelling the worldwide Algorithm Trading market?

- Who are the key players in the world Algorithm Trading industry?

- What are the factors impacting the revenue and production growth of the Algorithm Trading market?

- What are the opportunities challenges in the Algorithm Trading industry?

About Data Bridge Market Research:

About Us: Data Bridge Market Research set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge Market Research provides appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Data Bridge adepts in creating satisfied clients who reckon upon our services and rely on our hard work with certitude. Get Customization and Discount on Report by emailing [email protected] . We are content with our glorious 99.9 % client satisfying rate.

Contact:

Data Bridge Market Research

US: +1 888 387 2818

UK: +44 208 089 1725

Hong Kong: +852 8192 7475

Email: [email protected]