Foreign exchange, commonly referred to us as Forex, can be as simple as converting one currency to another currency, or as sophisticated as trading currency in the Forex market. The Forex market accounts for over $5 trillion in terms of volume being traded every day, making it the largest and most complex financial market in the world. Since the currency market is a huge and decentralized over-the-counter (OTC) exchange, one has to practice due diligence in selecting a Forex trading broker to understand the nitty-gritty of currency trading.To get more news about forex broker ranking, you can visit wikifx.com official website.

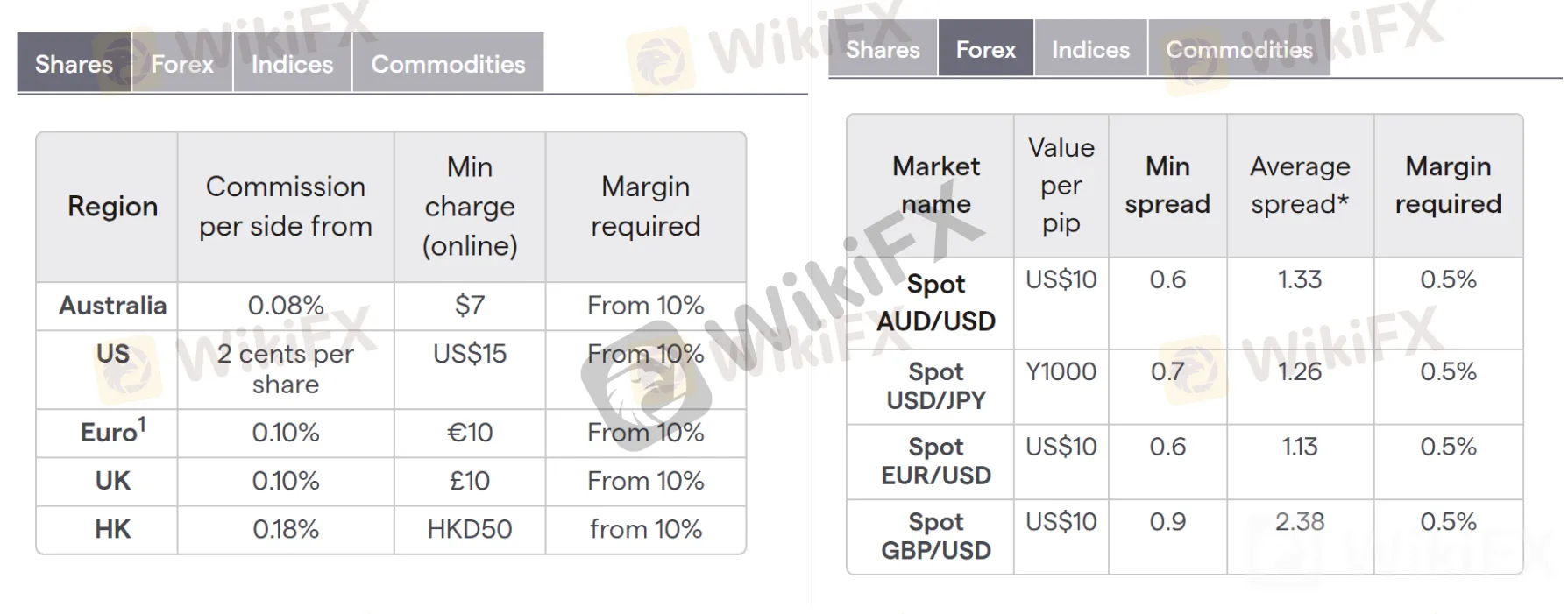

When considering how to choose the best Forex broker in 2023, one must understand the currency pair offering, account details (initial deposit, deposits/withdrawals, commissions/spreads, leverage, and margin), customer service, regulatory compliance, and trading platforms. Before selecting the best Forex broker, one should also invest time in reading reviews from that broker’s previous and current clients to have a sense of gauge how they fared when providing Forex services to people. Trading with the right broker is vital for a successful currency trading.

For this year’s edition of the best Forex brokers 2023, spent hours of rigorous data gathering and consolidation to curate the list of leading brokers. In particular, the multi-functional table below provides a detailed comparison of Forex brokers which can be adjusted to a person’s preference.

Those considering venturing into the elaborate Forex market may be wondering if currency trading can make a person wealthy. Some experts may say “no”, while others may respond “yes,” but with reservations. Forex trading with a broker requires pouring out money, doing thorough research, being courageous to take risks, and picking the best partner. The Forex market is not the perfect place for would-be billionaires. Just like any other jobs, becoming a successful Forex trader entails hard work, dedication, discipline, diligence, perseverance, patience and time management.

Even the most successful investors, like Warren Buffett, Carl Icahn, Benjamin Graham, Peter Lynch, and George Soros have lost large amounts of money and committed trading mistakes at some point in their careers. No investor is spared from investing blunders but everyone can learn more from failures than successes. It is important to reiterate, Forex trading is not the easiest way to amass riches, as one has to be prepared to take the plunge before reaping the fruits of the labor. Success with Forex trading will not happen overnight. There are no shortcuts to Forex trading. Not even the heavens can guarantee claims of a get-rich-quick scheme as one would think.

Finding the best Forex trading broker in 2023 has never been, is, and will never be, an easy feat. Conducting thorough research before picking the right Forex broker is critical. Going through all the brokers in the market can be a daunting task and entrusting currency trading to any entity requires a tremendous amount of trust and confidence.

TWO KINDS OF FOREX BROKER

Electronic Communications Network (ECNs) is an alternative trading system which digitally links market participants in order to buy or sell currencies, stocks, and other financial instruments with one another. Today there are many excellent ECN brokers on the Forex market. ECNs flash orders through a consolidated quote system which the public can view. Such entities rule out tapping a third party to facilitate transactions aside from helping investors make immediate and automatic transactions beyond trading hours.

Conversely, Market Makers display buy and sell rates for a guaranteed number of shares in a move to compete directly for customer order flows. To stay in the game, Market Makers Forex brokers must keep both bid and ask prices within a predetermined spread. Specifically, a market surfaces when the designated market maker sets the bidding price and offers over time, to make sure there are ample buyers and sellers for every market order. Market makers act as catalysts in the secondary market for beefing up liquidity and, subsequently, long-term growth in the currency market.

qocsuing

1245 Blog posts