Bronchoscopy is a medical procedure that involves the insertion of a flexible tube with a camera attached to it into the airways of the lungs. It is typically used to diagnose or treat lung conditions or to remove a foreign object that has been inhaled. The procedure may involve the use of a local anesthetic to help the patient relax, and an intravenous sedative may also be used. Images are typically taken of the inside of the lungs and can be used to diagnose a variety of conditions, including bronchitis, pneumonia, and asthma. Bronchoscopy may also be used to collect samples of tissue or fluid for further testing.

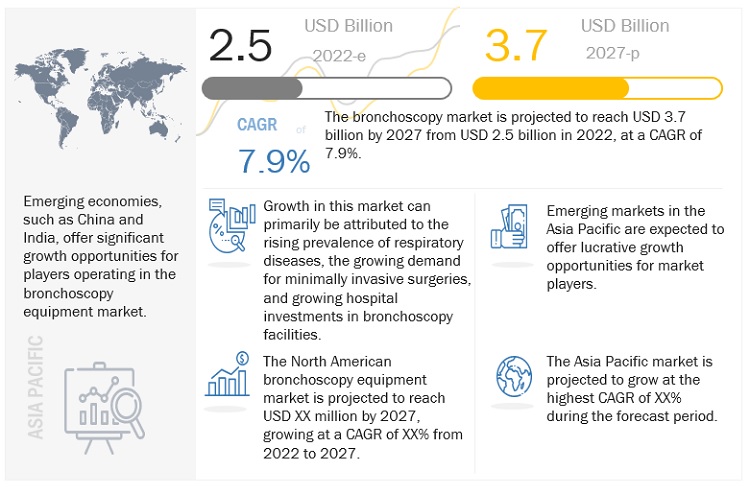

Currently, bronchoscopy market in terms of revenue was estimated to be worth $2.5 billion in 2022 and is poised to reach $3.7 billion by 2027, growing at a CAGR of 7.9% from 2022 to 2027. Market growth is largely driven by the rising prevalence of respiratory diseases, growing hospital investments in bronchoscopy facilities, and technological improvement in bronchoscopes. On the other hand, risk associated with the bronchoscopy procedures is a major restrains to the growth of this market.

Request for assumptions how numbers were triangulated.

https://www.marketsandmarkets.com/requestsampleNew.asp?id=40057877

Market Growth Drivers

- Rising prevalence of respiratory diseases

- Increasing cases of lung cancer

- Growing demand for minimally invasive surgeries

- Growing hospital investments in bronchoscopy facilities

- Technological advancements

Market Growth Opportunities

- Growing healthcare market in emerging economies

- Development of Novel Bronchoscopy Devices

- Increasing Awareness

Market Challenges

- Dearth of trained physicians and pulmonologists

- Lack of awareness among patients and healthcare providers

The prominent players operating in the bronchoscopy market are Olympus Corporation (Japan), KARL STORZ (Germany), Ambu A/S (Denmark), Boston Scientific Corporation (US), Ethicon (US), FUJIFILM Holdings Corporation (Japan), Medtronic (Ireland), HOYA Corporation (Japan), Richard Wolf GmbH (Germany), Cook Medical (US), Broncus Medical Inc. (China), CONMED (US), Roper Technologies (US), Teleflex Incorporated (US), Laborie Medical Technologies Corp. (Canada), EFER Endoscopy (France), EMOS Technology GmbH (Germany), VBM Medizintechnik GmbH (Germany), Hunan Vathin Medical Instrument Co., Ltd. (China), and Machida Endoscope Co., Ltd. (China)

BOSTON SCIENTIFIC CORPORATION (US)

Boston Scientific Corporation is a leading player in the bronchoscopy market. The company develops, manufactures, and markets medical devices for a range of interventional medical specialties (including interventional radiology, interventional cardiology, peripheral interventions, cardiac surgery, vascular surgery, endoscopy, oncology, urology, and gynecology). The company’s operating expenses comprise selling and marketing, general and administrative, and research and development expenses. In 2021, the company’s revenue was USD 11.8 billion, up from USD 9.91 billion in 2021. The company mainly focuses on maintaining or achieving technological leadership in its operating markets to help ensure that the patients using its devices receive advanced and effective treatments. In 2021, Lumenis entered into a definitive agreement to sell the Lumenis Surgical Business to Boston Scientific. The acquisition of Lumenis Surgical represents a major milestone for the Lumenis team and will enable Boston Scientific to enhance the execution of its urology strategy. Moreover, in 2022, Synergy Innovation, a manufacturer and distributor of medical devices for endoscopic and urologic procedures, and M.I.Tech Co., Ltd. entered into a final agreement with Boston Scientific Corporation to buy its majority stake (about 64%).

OLYMPUS CORPORATION (JAPAN)

Olympus Corporation held the second position in the bronchoscopy equipment market. The Medical Business segment, which provides bronchoscopy products, is the major source of revenue growth for Olympus. The company aims to strengthen its RD, manufacturing, quality, and regulatory assurance functions and also conducts efficient investments in this business segment to increase its growth potential and profitability. The company invested 10% of its total revenue in RD in 2021. The company invests a significant amount of its revenue in research and development to launch technologically advanced products in the market. Olympus’ Therapeutic Solutions Business revenue increased from USD 2.16 billion in 2020 to USD 2.65 billion in 2021. The company also focuses on organic and inorganic growth strategies to maintain its position in the market and expand its global presence.

KARL STORZ (GERMANY)

KARL STORZ held the third position in the bronchoscopy market. It has eight production sites globally and has service centers in Germany, Switzerland, the US, and India. Its products are marketed through a network of more than 50 subsidiaries in 40 countries and distribution agents across Europe, the Americas, Africa, and the Asia Pacific. The company is engaged in the production and sales of endoscopes, medical instruments, and devices used for medical, surgical, dental, and veterinary purposes. The company also provides industrial endoscopes for non-destructive testing, including videoscopes, borescopes, cameras, and documentation systems. The company has a wide product range for several categories, including neurosurgery, oral and maxillofacial surgery, plastic surgery, anesthesia and emergency medicine, cardiovascular surgery, thoracic surgery, and gastroenterology. The company offers rigid and flexible bronchoscopes for adults and pediatric use. KARL STORZ also offers essential accessories for bronchoscopy.

Download an Illustrative Overview:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=40057877

Report Objectives

- To define, describe, and forecast the bronchoscopy market based on product, usability, patient, end user, and region.

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, and opportunities)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall bronchoscopy equipment market

- To analyse market opportunities for stakeholders and provide details of the competitive landscape for key players.

- To forecast the size of the market segments in four geographical regions, namely, North America, Europe, the Asia Pacific, and Rest of the World.

- To profile the key players and comprehensively analyse their product portfolios, market positions, and core competencies.

- To track and analyse competitive developments such as product launches and approvals, deals and expansions in the bronchoscopy market.

Key developments:

- In 2022, Ethicon, a Johnson Johnson MedTech firm, declared today that the FDA granted 510(k) approval for its Monarch robotic surgery platform. The FDA has given Ethicon’s subsidiary Auris Health permission to use Monarch for endourological treatments. According to company representatives, it is currently the first and only versatile multispecialty robotic solution for use in both urology and bronchoscopy

- In 2022, Olympus announced the expansion of its respiratory portfolio with the launch of H-SteriScopes. In order to address the demands of infection prevention campaigns, Olympus announced the availability of its line of single-use foreign body retrieval devices, which gives doctors alternatives for a variety of purposes.

- In 2021, The EXALT Model B Single-use Bronchoscope, a single-use device intended for bedside operations in the intensive care unit, operating room, and bronchoscopy suite, received CE Mark approval

- In 2022, Olympus announced the strategic co-marketing agreement with Bracco Diagnostics Inc., which is a US subsidiary of Bracco Imaging S.p.A., a major international player in the diagnostic imaging industry. Bracco Imaging S.p.A. is a leader in the creation and delivery of new solutions for medical and surgical operations.

- In 2022, Olympus announced that its line of single-use bronchoscopes had been selected for the new Vizient Single-use Visualization Devices contract.

- In 2021, FUJIFILM Holdings Corporation announced that its complete portfolio of endoscopy and endosurgery products is available to members of Vizient.

Content Source:

https://www.marketsandmarkets.com/Market-Reports/bronchoscopes-market-40057877.html

https://www.marketsandmarkets.com/PressReleases/bronchoscopes.asp