Digital Insurance Platform Market Overview:

The Digital Insurance Platform Market analysis provides a full insight into the competition, including the market share and company profiles of the key worldwide rivals. The scope of the research covers a thorough investigation of the Digital Insurance Platform Market, as well as the causes for variances in the industry’s growth in different regions.

The Digital Insurance Platform Market size is expected to reach nearly US $ 241.25 Bn by 2029 with the CAGR of 13.7% during the forecast period.

Available Exclusive Sample Copy of this Report @

https://www.maximizemarketresearch.com/request-sample/11893

Market Scope:

Following the completion of market engineering, which comprised market statistics calculations, estimations of market size, market projections, market breakdown, and data triangulation, major primary research was conducted to obtain information and verify and validate critical numbers. Top-down and bottom-up strategies, as well as several data triangulation procedures, were often used throughout the market engineering process to perform market estimating and forecasting for the overall market segments and sub-segments discussed in this research. In order to give vital information throughout the report, extensive qualitative and quantitative analysis is done on all data gathered throughout the market engineering process.

Segmentation:

The automotive and transportation segment has been a major market for digital insurance platforms in terms of application areas. Technologies like artificial intelligence and telematics have help insurance companies to streamline the business operations along with deploying newer channels of insurance distribution. The digital insurance platform allows customers to search anywhere online for quotation, compare insurance policies, and get a suitable coverage in no time. The rise in the number of accidents has been another crucial factor to boost the digital insurance platform in automotive and transportation application segment.

Purchase Inquiry:

https://www.maximizemarketresearch.com/request-sample/11893

Key Players:

Primary and secondary research is used to identify market leaders, and primary and secondary research are used to calculate market revenue. In-depth interviews with important thought leaders and industry professionals such as experienced front-line staff, CEOs, and marketing executives were conducted as part of the primary study. Primary research comprised in-depth interviews with key thought leaders and industry professionals such as experienced front-line staff, CEOs, and marketing executives, while secondary research included a review of the main manufacturers’ annual and financial reports. Secondary data is used to determine percentage splits, market shares, growth rates, and worldwide market breakdowns, which are then cross-checked with primary data.

• The biggest players in the Digital Insurance Platform Market are as follows:

• Accenture

• TCS

• IBM

• DXC Technology

• Mindtree

• Prima Solutions

• Oracle

• Microsoft

• SAP

• Cogitate Technology Solutions

• Cognizant

• Inzura

• Pegasystems

• Fineos

• Duck Creek

• RGI Group

• Infosys

• Bolt Solutions

• EIS Group

• StoneRiver

• Vertafore

• Appian

• Majesco

• Internet Pipeline

• Ebaotech

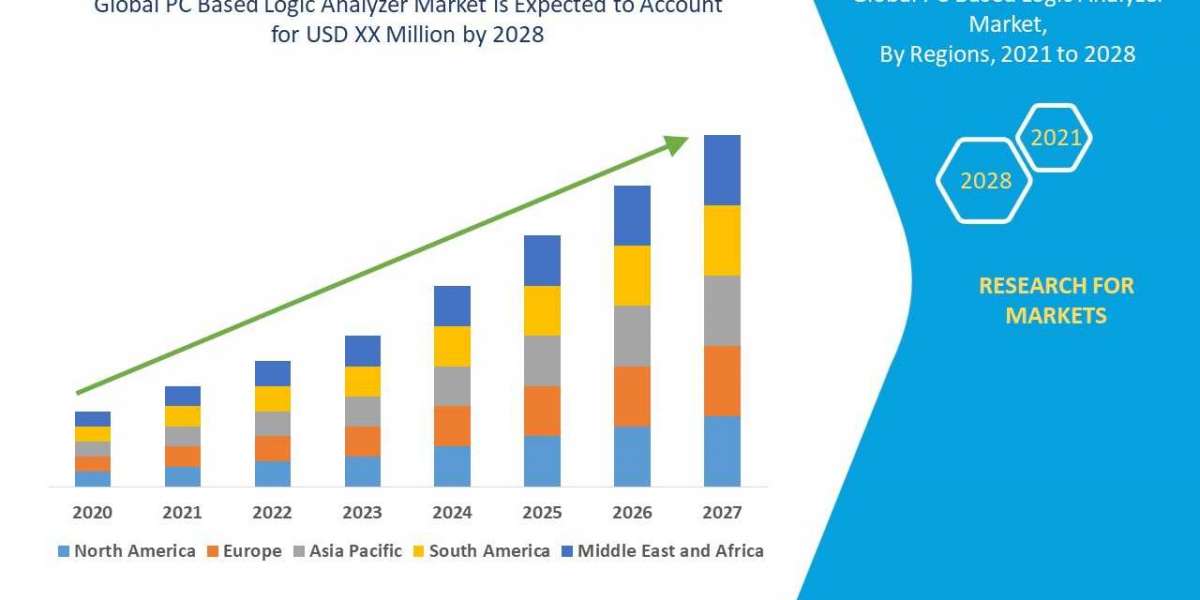

Regional Analysis:

Individual market influencing components and changes in market regulations affecting the present and future market trends are also included in the regional overview of the Digital Insurance Platform Market analysis. Current and future trends are researched in order to assess the entire market potential and identify profitable patterns in order to get a stronger foothold. The geographical market assessment is based on the present environment and expected developments.

COVID-19 Impact Analysis on Digital Insurance Platform Market:

End-user industries where Digital Insurance Platform Market is utilized saw a dip in growth from January 2020 to May 2020 in a number of countries, including China, Italy, Germany, the United Kingdom, the United States, Spain, France, and India, due to a pause in operations. This resulted in a significant decrease in the revenues of businesses working in these industries and, as a result, in demand for Digital Insurance Platform Market manufacturers, influencing the development of the Digital Insurance Platform Market in 2020. End-user business demand for Digital Insurance Platform Market has declined significantly as a result of lockdowns and an increase in COVID-19 events worldwide.

Key Questions Answered in the Digital Insurance Platform Market Report are:

In 2021, which segment held the highest proportion of the Digital Insurance Platform Market?

What is the Digital Insurance Platform Market’s competitive landscape?

What are the primary drivers assisting the Digital Insurance Platform Market growth?

Which region has the most market share in the Digital Insurance Platform Market?

What will be the Digital Insurance Platform Market’s CAGR throughout the projected period?

Request For Free Sample @

https://www.maximizemarketresearch.com/request-sample/11893

About Us:

Maximize Market Research provides B2B and B2C research on 12000 high-growth emerging opportunities technologies as well as threats to the companies across the Healthcare, Pharmaceuticals, Electronics Communications, Internet of Things, Food and Beverages, Aerospace and Defence, and other manufacturing sectors.

Contact Us:

MAXIMIZE MARKET RESEARCH PVT. LTD

3rd Floor, Navale IT Park Phase 2,

Pune Banglore Highway,

Narhe, Pune, Maharashtra 411041, India.

+91 96071 95908, +91 9607365656