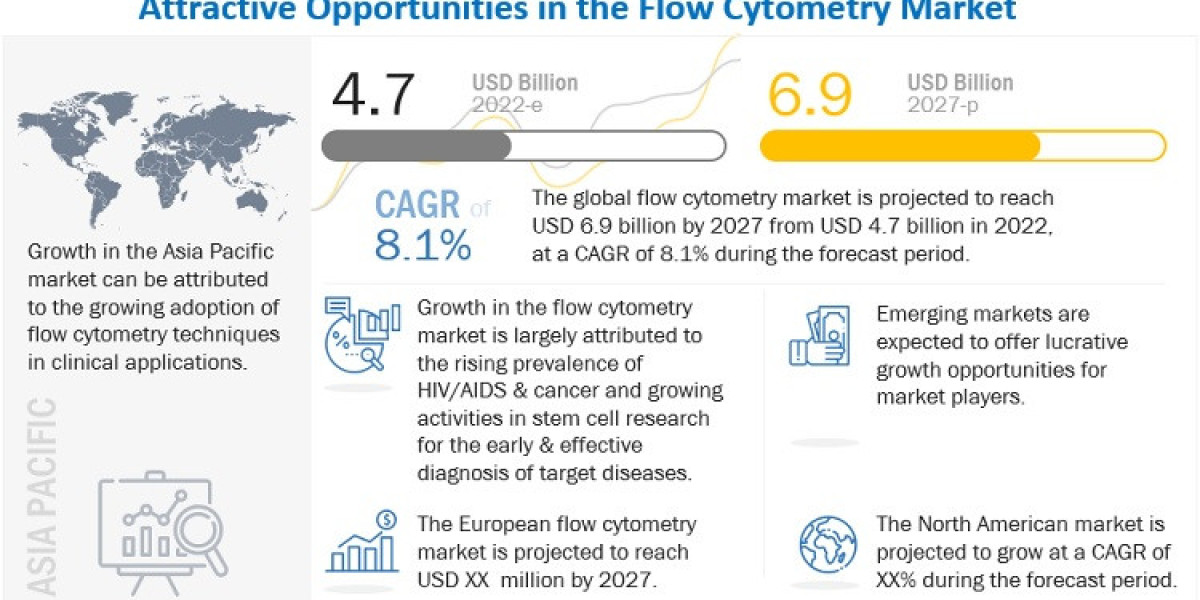

The growth of the Flow Cytometry Market is largely driven by the rising prevalence of HIV/AIDS and cancer, growing adoption of flow cytometry techniques in research activities, increasing public-private initiatives in immunology and immuno-oncology research, and rising technological advancements in flow cytometry software.

Flow Cytometry Market is projected to grow from USD 4.7 billion in 2022 to USD 6.9 billion by 2027, at a CAGR of 8.1% from 2022 to 2027 according to a new report by MarketsandMarkets™.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=65374584

Browse in-depth TOC on "Flow Cytometry Market"

331 – Tables

37 – Figures

332 – Pages

Flow Cytometry Market Dynamics:

Drivers:

- Increasing incidence of HIV/AIDS and cancer

- Flow cytometry techniques in research activities

- Use of flow cytometry in regenerative medicine

- Growing public−private initiatives in immunology and immuno-oncology research

- Technological advancements in flow cytometry instruments

Restraints:

- High product cost

Opportunities:

- Emerging markets

- Public-private funding initiatives in stem cell research

- Adoption of recombinant DNA technology for antibody production

Challenges:

- Complexities related to reagent development

- Shortage of well-trained and skilled professionals

Markets Segmentation:

- Based on product & service, the market is segmented into reagents & consumables, instruments, software, services, and accessories. Reagents & consumables accounted for the largest share in the market in 2021.

- Based on applications, the market is segmented into research, clinical, and industrial applications. In 2021, the research applications segment accounted for the largest share in the global market.

Inquiry Before Buying:

https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=65374584

Regional Analysis:

The Asia Pacific region has witnessed significant growth in the flow cytometry market over the years. Countries such as China, Japan, India, and South Korea have been key contributors to this growth. Rapid advancements in healthcare infrastructure, increasing research and development activities, and rising investments in the biotechnology and pharmaceutical sectors have fueled the market expansion in this region.

Geographically, the Flow Cytometry Market is segmented into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest share in the global market in 2021.

Recent Developments: -

- In June 2022, BD (US) launched BD FACSDiscover S8 Cell Sorter with high-speed imaging technology that sorts cells based on visual characteristics.

- In March 2022, Beckman Coulter, Inc. (US) launched a fully automated sample preparation system (SPS) CellMek SPS, which offers on-demand processing for many sample types to help laboratories expand capabilities

Top Key Players: -

The prominent players in the Flow Cytometry Market are Becton, Dickinson and Company (US), Danaher Corporation (US), Thermo Fisher Scientific, Inc. (US), Agilent Technologies, Inc. (US), and Luminex Corporation (US). These companies have adopted organic and inorganic growth strategies, such as product launches and acquisitions, to maintain their leading positions in the market.