The world of finance is a tapestry woven with threads of economic interactions, where currencies serve as the lifeblood of global trade. Among these, the Japanese Yen (JPY) and United States Dollar (USD) stand as two major players. In this exploration, we delve into the historical exchange rates of JPY/USD, unraveling the story of their complex relationship through the analytical lens of Python.

Understanding JPY/USD Dynamics

The JPY and USD are stalwarts in the world of international finance. As a safe-haven currency, the JPY often reflects market sentiments during uncertainties. Conversely, the USD holds a pivotal position as the world's primary reserve currency. Understanding the interplay between these two currencies is key to deciphering economic trends and geopolitical dynamics.

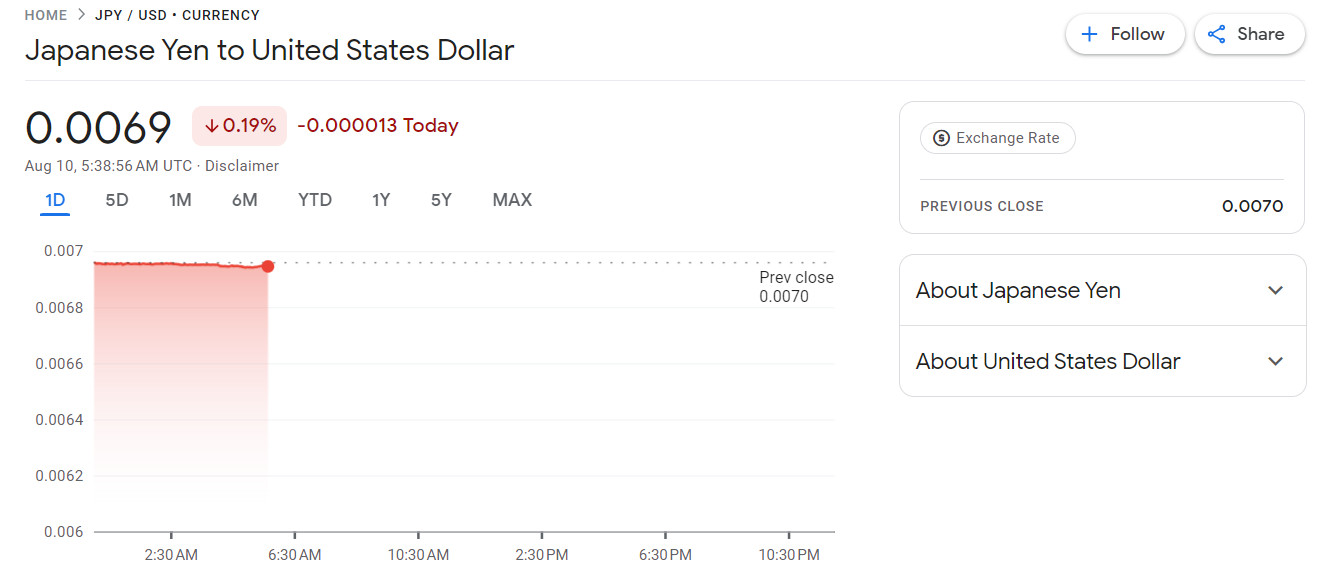

A Glimpse into Historical Exchange Rates

The historical exchange rates between JPY and USD narrate a tale of economic evolution. From Japan's post-World War II recovery to the rise of the Asian Tiger, and the dot-com boom to the financial crisis of 2008, these rates bear witness to pivotal moments in global history. Their trajectories reflect the shifting balance of economic power and influence over decades.

Python: A Tool for Unraveling History

Python, with its data analysis capabilities, is a boon for decoding the intricacies of historical exchange rates. Leveraging libraries like Pandas and NumPy, analysts can sift through extensive datasets, cleanse data, and transform it into meaningful insights. The versatility of Python makes it an ideal tool to conduct historical analysis, revealing patterns and trends that shape the JPY/USD exchange rates.

Unveiling Insights through Analysis

Python's visualization libraries, including Matplotlib and Seaborn, enable us to portray historical exchange rate data in a comprehensible manner. Line charts illustrate the ebb and flow of rates over time, offering insights into economic events and policy decisions. Candlestick charts delve into market sentiments, while heatmaps highlight correlations that have influenced JPY/USD dynamics.

A Window into the Future

While the past illuminates the present, it also hints at potential futures. Python's machine learning capabilities allow analysts to create predictive models based on historical data. These models project likely scenarios for JPY/USD exchange rates, aiding traders and investors in making informed decisions amidst a sea of market volatility.

In Conclusion

The historical exchange rates of JPY/USD serve as a historical archive of economic evolution and global events. Through the lens of Python, we dissect these rates, uncovering hidden patterns and relationships that shape financial narratives. By understanding their historical journey, we gain insights that guide us through the complex currents of today's financial world. As we stand at the confluence of historical understanding and modern analytical tools, we equip ourselves to navigate the ever-changing landscape of global finance.